Frequently Asked Questions

Results (21)

Click the question to read the answer.

-

If you are required to pay a fee during registration or when you are providing an annual data report for Batteries, Tires, and/or Electronics you can select from one of the following payment methods:

- Bank withdrawal (pre-authorized debit)

- Credit card

- Electronic data interchange (EDI)

- Electronic bill

- Cheque

If you are required to pay a fee during manual registration for Blue Box and/or Hazardous and Special Products, you can select from one of the following payment methods:

- Electronic data interchange (EDI)

- Electronic bill

- Cheque

Instructions for submitting your payment are provided during the registration process.

-

We recommend using Google Chrome, Mozilla Firefox, Microsoft Edge or Apple Safari when accessing the Registry. If you are experiencing an issue with the Registry, try updating the browser to the latest version.

If you are using a different browser, the Registry will not function.

-

You should use the address where you carry on business. If you carry on business in more than one location in Ontario, use the main address for your business in Ontario. If you do not have an Ontario address, use the address that relates to the activities you carry out in Ontario.

-

Producers will be required to pay a program fee as part of the registration process, which supports the Authority’s operations. Program fees cover the Authority’s costs related to building and operating the electronic Registry, and compliance and enforcement activities.

For more information, refer to the 2022 RRCEA Program Fee Schedule for Batteries, Blue Box, ITT/AV, HSP, Lighting, and Tires.

-

To register as a PRO, contact the Compliance and Registry Team at registry@rpra.ca or call 647-496-0530 or toll-free 1-833-600-0530.

-

Resident in Ontario means a person having a permanent establishment in Ontario within the meaning of the Corporations Tax Act. A permanent establishment is usually a fixed place of business such as an office, factory, branch, warehouse, workshop, etc. In some cases, a corporation will be deemed to operate a permanent establishment in Ontario. These include cases where:

- The corporation produced, grew, mined, created, manufactured, fabricated, improved, packed, preserved or constructed anything in the province, in whole or in part;

- The corporation carries on business through an employee or agent in the province who has general authority to contract for the corporation; or

- The corporation carries on business through an employee or agent in the province who has a stock of merchandise owned by the corporation from which they regularly fill orders that they receive.

- A corporation will also have a permanent establishment in Ontario if it uses substantial machinery or equipment in the province, or if it is has a permanent establishment elsewhere in Canada and owns land in the province.

For more details about what constitutes a permanent establishment, see the definition of “permanent establishment” in the Corporations Tax Act.

-

To create a Registry account with the Authority, you will need to provide:

- CRA Business Number (BN)

- Legal Business Name

- Business address and phone number

- Address of where you work (if different from the main office)

- Contact information for your billing contact (this may also be added later)

-

For regulatory purposes, we need to know your legal name — the name you are incorporated under. We also need to know your business operating name if it is different from your legal business name to add to our published list of registrants. The list of registrants will be available on our website to allow registrants to interact with one another and to provide information to the public.

For example, if you are a registered collector and your legal name is 123456789 Ontario Ltd. and your business operating name is “Jack’s Garage,” a member of the public looking for a place to drop off used tires will need to know the name you are operating under to identify your location.

-

You are considered a battery producer under the Batteries Regulation if you market batteries into Ontario and meet the following requirements:

- Are the brand holder of the battery and have residency in Canada;

- If there is no resident brand holder, have residency in Ontario and import batteries from outside of Ontario;

- If there is no resident importer, have residency in Ontario and markets directly to consumers in Ontario (e.g., online sales); or

- If there is no resident marketer, does not have residency in Ontario and markets directly to consumers in Ontario (e.g., online sales).

Even if you do not meet the above definition, there may be circumstances where you qualify as a producer. Read the Batteries Regulation for more detail or contact the Compliance and Registry Team for guidance at registry@rpra.ca or (647) 496-0530 or toll-free at (833) 600-0530.

-

The Batteries Regulation applies to the following types of batteries sold separately in Ontario (e.g., not embedded in products):

- Single-use (primary) batteries weighing 5 kg or less and sold separately from products; and

- Rechargeable batteries weighing 5 kg or less and sold separately from products.

Examples of single-use and rechargeable batteries that fall under the Batteries Regulation are button cells, AA, AAA, C, D, 9V, lantern batteries, sealed lead-acid batteries, and replacement batteries for products (for example, drill, cell phone, laptop) that weigh under 5 kg or less.

The regulation does not apply to the following:

- Batteries sold with or in products (for example, batteries sold with or in drills, cell phones, laptops, toys, vapes, fire alarms); or

- Batteries over 5 kg (for example, car batteries, forklift batteries, stationary batteries).

For more information, see the Compliance Bulletin: What batteries have to be reported?

If you have questions about what items are and are not covered under the Batteries Regulation, contact the Compliance and Registry Team at registry@rpra.ca or (647) 496-0530 or toll-free at (833) 600-0530.

-

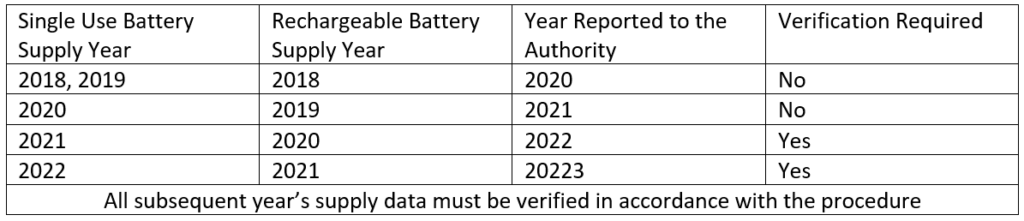

There is no audit verification requirement for the first two supply data reports submitted to the Authority. Therefore, data submitted for single-use batteries supplied in 2018, 2019, and 2020, as well as rechargeable batteries supplied in 2018 and 2019 will not have to be verified in accordance with the Registry Procedure – Verification and Audit.

As shown in the table below, under section 15 of the Battery Regulation, the first supply data report for which there are audit and verification requirements will be submitted in 2022. This supply data report is for single-use batteries supplied in 2021 and rechargeable batteries supplied in 2020.

-

Yes. You are still required to register with the Authority Registry even if you already have an existing account.

-

A battery producer qualifies for an exemption if its management requirement is less than 1.25 tonnes of rechargeable batteries or less than 2.5 tonnes of single-use batteries. A producer’s management requirement is calculated as a percentage of the weight of batteries supplied into Ontario in a specific period. This calculation changes each year, and therefore producers should verify whether they qualify for an exemption annually.

For information about how to calculate your management requirement, refer to our FAQ, How are battery producer minimum management requirements determined?

A producer who meets the weight exemption and has five or more full-time employees does not have collection or management requirements but is required to register and report battery supply data to the Authority.

A producer who meets the weight exemption and has less than five full-time employees has no obligation under the Batteries Regulation.

Producers who want to confirm their status as an exempt producer should contact the Compliance Team at registry@rpra.ca or 833-600-0530.

-

As of July 1, 2020, producers are required to establish and operate a collection system for batteries that meets the accessibility requirements in the regulation. Producers must ensure that all batteries collected are managed regardless of their minimum management requirements.

For producers to meet their obligations, they have the choice of establishing and operating their own collection and management system or working with one or more producer responsibility organizations (PROs) that are registered with the Authority.

Please contact the Compliance Team at 833-600-0530 or registry@rpra.ca to discuss other requirements under the Batteries Regulation.

-

Any battery producer who marketed batteries in Ontario between January 1, 2018, and November 30, 2020, must register with the Authority by completing the registration form and emailing it as an attachment to registry@rpra.ca by January 31, 2021.

-

As the Regulator responsible for enforcing regulations under the Resource Recovery and Circular Economy Act, 2016, the Registrar uses their discretion for when it is necessary to give registrants more time to collect the information needed for registration and/or reporting.

-

RPRA does not vet PROs before listing them on the website. Any business that registers as a PRO will be listed. Producers should do their own due diligence when determining which PRO to work with.

-

Account Admins must add any new, or manage existing, Primary Contacts under the program they wish to give them access to in order for the Primary Contact to be able to submit a report (e.g., permissions to view and complete reports).

To Manage contacts on your Registry account, please see the following steps:

- Log into your account

- Once you are logged in, click on the drop-down arrow in the top right corner and select Manage Users

- Under Actions, click Manage to update preferences of existing users

- Click Add New User to add an additional contact to your account

- To give reporting access to a Primary Contact, select the program from the drop-down that you would like to grant them access to

-

No, only producers are required to pay RPRA program fees. The decision to make producers pay fees and cover the Authority’s costs was made to reflect the fact that the Resource Recovery and Circular Economy Act, 2016 (RRCEA) is based on a producer responsibility framework. Although producers may hire service providers to help meet their obligations, the responsibility remains with the producer.

-

test faq test

-

test answer