Frequently Asked Questions

Results (50)

Click the question to read the answer.

-

Here are the lists of registered PROs:

Hazardous and Special Products PROs

These lists will continue to be updated as new PROs register with RPRA.

-

If you are required to pay a fee during registration or when you are providing an annual data report for Batteries, Tires, and/or Electronics you can select from one of the following payment methods:

- Bank withdrawal (pre-authorized debit)

- Credit card

- Electronic data interchange (EDI)

- Electronic bill

- Cheque

If you are required to pay a fee during manual registration for Blue Box and/or Hazardous and Special Products, you can select from one of the following payment methods:

- Electronic data interchange (EDI)

- Electronic bill

- Cheque

Instructions for submitting your payment are provided during the registration process.

-

We recommend using Google Chrome, Mozilla Firefox, Microsoft Edge or Apple Safari when accessing the Registry. If you are experiencing an issue with the Registry, try updating the browser to the latest version.

If you are using a different browser, the Registry will not function.

-

You should use the address where you carry on business. If you carry on business in more than one location in Ontario, use the main address for your business in Ontario. If you do not have an Ontario address, use the address that relates to the activities you carry out in Ontario.

-

Yes. PROs are private enterprises and charge for their services to producers.

Each commercial contract a producer enters with a PRO will have its own set of terms and conditions. It is up to the PRO and producer to determine the terms of their contractual agreement, including fees and payment schedule.

RPRA does not set the terms of the contractual arrangements between PROs and producers.

-

No. A PRO cannot report on behalf of service providers.

-

Yes. Producers and service providers can enter into contractual agreements with multiple PROs.

-

No. Section 68 subsection (3) of the Resource Recovery and Circular Economy Act states that “a person responsible for establishing and operating a collection system shall ensure that no charge is imposed at the time of the collection.”

-

Producers will be required to pay a program fee as part of the registration process, which supports the Authority’s operations. Program fees cover the Authority’s costs related to building and operating the electronic Registry, and compliance and enforcement activities.

For more information, refer to the 2022 RRCEA Program Fee Schedule for Batteries, Blue Box, ITT/AV, HSP, Lighting, and Tires.

-

To register as a PRO, contact the Compliance and Registry Team at registry@rpra.ca or call 647-496-0530 or toll-free 1-833-600-0530.

-

No. Producers and PROs working on their behalf must operate the collection systems they have established as required by the Regulation even after their requirements are met. If a consumer is refused permission to drop off materials at a registered collection site, they can contact the Compliance and Registry Team at registry@rpra.ca, 647-496-0530 or toll-free at 1-833-600-0530.

-

Under the Resource Recovery and Circular Economy Act, the Authority is required to provide an annual report to the Minister that includes information on aggregate producer performance, and a summary of compliance and enforcement activities. Under section 51 of the Act, the Registrar also is required to post every order issued on the Registry.

-

A producer responsibility organization (PRO) is a business established to contract with producers to provide collection, management, and administrative services to help producers meet their regulatory obligations under the Regulation, including:

- Arranging the establishment or operation of collection and management systems (hauling, recycling, reuse, or refurbishment services)

- Establishing or operating a collection or management system

- Preparing and submitting reports

PROs operate in a competitive market and producers can choose the PRO (or PROs) they want to work with. The terms and conditions of each contract with a PRO may vary.

-

No. The Authority does not administer contracts or provide incentives. Under the Regulations, producers will either work with a producer responsibility organization (PRO) or work directly with collection sites, haulers, refurbisher’s and/or processors to meet their collection and management requirements. Any reimbursement for services provided towards meeting a producers’ collection and management requirements will be determined through commercial contracts.

To discuss any payment, contact your service provider or a PRO. RPRA does not set the terms of the contractual arrangements between PROs and producers.

-

Resident in Ontario means a person having a permanent establishment in Ontario within the meaning of the Corporations Tax Act. A permanent establishment is usually a fixed place of business such as an office, factory, branch, warehouse, workshop, etc. In some cases, a corporation will be deemed to operate a permanent establishment in Ontario. These include cases where:

- The corporation produced, grew, mined, created, manufactured, fabricated, improved, packed, preserved or constructed anything in the province, in whole or in part;

- The corporation carries on business through an employee or agent in the province who has general authority to contract for the corporation; or

- The corporation carries on business through an employee or agent in the province who has a stock of merchandise owned by the corporation from which they regularly fill orders that they receive.

- A corporation will also have a permanent establishment in Ontario if it uses substantial machinery or equipment in the province, or if it is has a permanent establishment elsewhere in Canada and owns land in the province.

For more details about what constitutes a permanent establishment, see the definition of “permanent establishment” in the Corporations Tax Act.

-

To create a Registry account with the Authority, you will need to provide:

- CRA Business Number (BN)

- Legal Business Name

- Business address and phone number

- Address of where you work (if different from the main office)

- Contact information for your billing contact (this may also be added later)

-

For regulatory purposes, we need to know your legal name — the name you are incorporated under. We also need to know your business operating name if it is different from your legal business name to add to our published list of registrants. The list of registrants will be available on our website to allow registrants to interact with one another and to provide information to the public.

For example, if you are a registered collector and your legal name is 123456789 Ontario Ltd. and your business operating name is “Jack’s Garage,” a member of the public looking for a place to drop off used tires will need to know the name you are operating under to identify your location.

-

Brand holders and producers that supply products and packaging are required by legislation to meet individual mandatory collection and resource recovery requirements and may face compliance and enforcement consequences for failing to do so. The executive attestation ensures that executives responsible for managing the brand holder’s or producer’s business are aware of these requirements and can ensure that appropriate measures are put in place to achieve compliance with the regulations.

-

Individual Producer Responsibility (IPR) means that producers are responsible and accountable for collecting and managing their products and packaging after consumers have finished using them.

Under the regulation, producers are directly responsible and accountable for meeting mandatory collection and recycling requirements for end of life products. With IPR, producers have choice in how they meet their requirements. They can collect and recycle the products themselves, or contract with producer responsibility organizations (PROs) to help them meet their requirements.

-

The Authority is the regulator designated by law to oversee the operation and wind up of current waste diversion programs under the Waste Diversion Transition Act, 2016. The Authority provides oversight, compliance, and enforcement activities with respect to regulations made under the Resource Recovery and Circular Economy Act, 2016.

-

The Authority recognizes the commercially sensitive nature of the information that parties submit to the registry. The Authority is committed to protecting the commercially sensitive information and personal information it receives or creates in the course of conducting its regulatory functions. In recognition of this commitment, the Authority, in addition to the regulatory requirements of confidentiality set out in the Resource Recovery and Circular Economy Act 2016 (section 57), has created an Access and Privacy Code that applies to its day-to-day operations, including the regulatory functions that it carries out.

Obligated material supply, collection, and resource recovery data will only be made public in aggregate form, to protect the confidentiality of commercially sensitive information.

The Authority will publish the names and contact information of all registered businesses – producers, service providers (collectors, haulers, processors, etc.), and producer responsibility organizations. The public will also have access to a list or method to locate any obligated material collection sites, as this information becomes available.

As part of its regulatory mandate, the Registrar will provide information to the public related to compliance and enforcement activities that have been undertaken.

The information that is submitted to the Registry will be used by the Registrar to confirm compliance and to track overall collection and management system performance. It will also be used by the Authority to update its policies and procedures and by the Ministry of Environment, Conservation and Parks for policy development.

-

In accordance with the legislation (Resource Recovery Circular Economy Act 2016, section 57), the Authority is required to comply with strict confidentiality requirements. The Authority has also developed an Access and Privacy Code that applies to its day-to-day operations.

The Registry has been developed according to cybersecurity best practice principles. This includes VPN-based restrictions, staff training on all cybersecurity policies, staff access to the Registry on a strict role-requirement basis, and registry interface security features (example: two-factor authentication).

-

A volunteer organization is a person who:

- Is a brand holder who owns a brand that is used in respect of batteries or EEE;

- Is not a resident in Canada;

- Has registered with the Authority; and

- Has entered into a written agreement with a producer for the purpose of carrying out one or more producer responsibilities.

A volunteer organization is not a producer but can take on the registration and reporting responsibilities for producers in relation to its brand. Under the Regulation, producers remain responsible for meeting their management requirements and cannot pass off their obligations through voluntary remitter agreements or any other commercial agreement.

Any brand holder or producer who is interested in making any agreement as indicated (or described) above, should contact the Compliance Team at registry@rpra.ca, 647-496-0530 or toll-free at 1-833-600-0530.

-

You are considered a battery producer under the Batteries Regulation if you market batteries into Ontario and meet the following requirements:

- Are the brand holder of the battery and have residency in Canada;

- If there is no resident brand holder, have residency in Ontario and import batteries from outside of Ontario;

- If there is no resident importer, have residency in Ontario and markets directly to consumers in Ontario (e.g., online sales); or

- If there is no resident marketer, does not have residency in Ontario and markets directly to consumers in Ontario (e.g., online sales).

Even if you do not meet the above definition, there may be circumstances where you qualify as a producer. Read the Batteries Regulation for more detail or contact the Compliance and Registry Team for guidance at registry@rpra.ca or (647) 496-0530 or toll-free at (833) 600-0530.

-

The Batteries Regulation applies to the following types of batteries sold separately in Ontario (e.g., not embedded in products):

- Single-use (primary) batteries weighing 5 kg or less and sold separately from products; and

- Rechargeable batteries weighing 5 kg or less and sold separately from products.

Examples of single-use and rechargeable batteries that fall under the Batteries Regulation are button cells, AA, AAA, C, D, 9V, lantern batteries, sealed lead-acid batteries, and replacement batteries for products (for example, drill, cell phone, laptop) that weigh under 5 kg or less.

The regulation does not apply to the following:

- Batteries sold with or in products (for example, batteries sold with or in drills, cell phones, laptops, toys, vapes, fire alarms); or

- Batteries over 5 kg (for example, car batteries, forklift batteries, stationary batteries).

For more information, see the Compliance Bulletin: What batteries have to be reported?

If you have questions about what items are and are not covered under the Batteries Regulation, contact the Compliance and Registry Team at registry@rpra.ca or (647) 496-0530 or toll-free at (833) 600-0530.

-

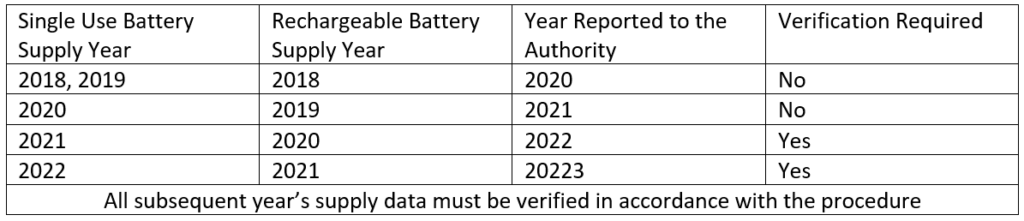

There is no audit verification requirement for the first two supply data reports submitted to the Authority. Therefore, data submitted for single-use batteries supplied in 2018, 2019, and 2020, as well as rechargeable batteries supplied in 2018 and 2019 will not have to be verified in accordance with the Registry Procedure – Verification and Audit.

As shown in the table below, under section 15 of the Battery Regulation, the first supply data report for which there are audit and verification requirements will be submitted in 2022. This supply data report is for single-use batteries supplied in 2021 and rechargeable batteries supplied in 2020.

-

Yes. You are still required to register with the Authority Registry even if you already have an existing account.

-

Producer supply data is used to calculate their individual minimum management requirements under the Batteries Regulation.

To learn how calculations are formulated, visit the FAQ How are battery producer minimum management requirements determined?

-

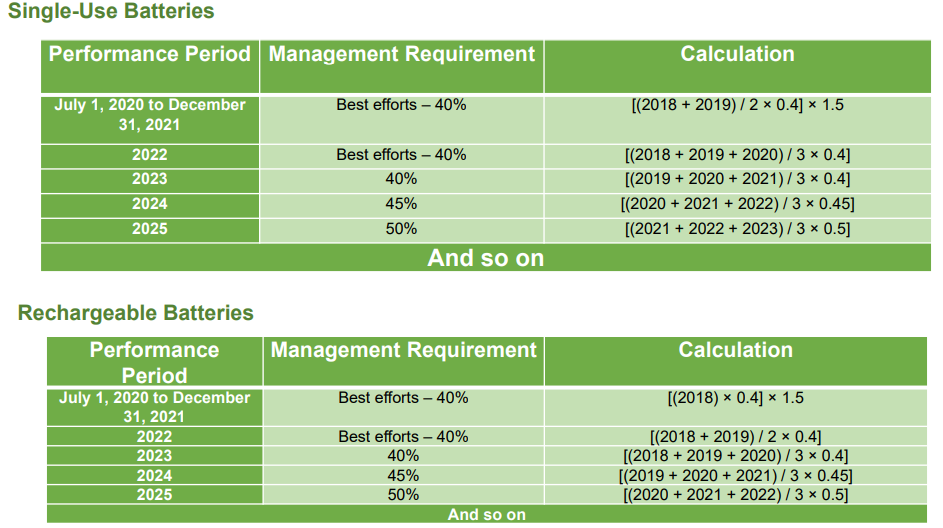

A producer’s individual management requirements are determined by the following formulas found in section 13 of the Regulation:

It is important to note that producer’s must ensure that all batteries collected are managed regardless of their minimum management requirement.

-

A battery producer qualifies for an exemption if its management requirement is less than 1.25 tonnes of rechargeable batteries or less than 2.5 tonnes of single-use batteries. A producer’s management requirement is calculated as a percentage of the weight of batteries supplied into Ontario in a specific period. This calculation changes each year, and therefore producers should verify whether they qualify for an exemption annually.

For information about how to calculate your management requirement, refer to our FAQ, How are battery producer minimum management requirements determined?

A producer who meets the weight exemption and has five or more full-time employees does not have collection or management requirements but is required to register and report battery supply data to the Authority.

A producer who meets the weight exemption and has less than five full-time employees has no obligation under the Batteries Regulation.

Producers who want to confirm their status as an exempt producer should contact the Compliance Team at registry@rpra.ca or 833-600-0530.

-

As of July 1, 2020, producers are required to establish and operate a collection system for batteries that meets the accessibility requirements in the regulation. Producers must ensure that all batteries collected are managed regardless of their minimum management requirements.

For producers to meet their obligations, they have the choice of establishing and operating their own collection and management system or working with one or more producer responsibility organizations (PROs) that are registered with the Authority.

Please contact the Compliance Team at 833-600-0530 or registry@rpra.ca to discuss other requirements under the Batteries Regulation.

-

Any battery producer who marketed batteries in Ontario between January 1, 2018, and November 30, 2020, must register with the Authority by completing the registration form and emailing it as an attachment to registry@rpra.ca by January 31, 2021.

-

Businesses have the choice to recover the cost of recycling their products by incorporating those costs into the overall cost of their product (as they do with other costs, such as materials, labour, other regulatory compliance costs, etc.) or by charging it as a separate fee to consumers.

Environmental fees on batteries, electronics, hazardous and special products or tires are not mandatory and are applied at the discretion of the business charging them, including the amount of the fee.

-

Consumer protection laws in Ontario require that the purpose of a visible fee cannot be misrepresented. This means that if a business decides to charge an environmental fee on batteries, electronics or tires, the fee:

- must reflect the business’ actual cost of recycling the product; and

- cannot be presented as a government tax, a RPRA fee or something similar.

There are additional rules in the tires regulation about visible fees related to recycling tires. For information about the rules for charging recycling fees on tires, refer to the compliance bulletin Charging Tire Fees to Consumers.

-

There is no set environmental fee for any product. The amount of the fee charged is decided by the business and must reflect the actual cost of recycling that product.

The tires regulation has specific rules about how a visible fee is communicated to consumers, and how tire retailers and producers must document and report on their use of visible fees. Refer to the compliance bulletin Charging Tire Fees to Consumers for details.

-

No. An environmental fee is not a government tax and cannot be represented as mandatory, a regulatory charge, or a RPRA fee. It is a fee charged at the discretion of a business to recover their costs related to recycling the product.

-

If you are concerned about the fee you were charged, you should contact the business that charged you the fee to request a more detailed explanation of how the fee was determined.

If you are concerned about a tire handling fee, you can contact the Compliance and Registry Team at registry@rpra.ca and our team will review to ensure that the rules for charging tire fees were followed.

-

In 2020, the Authority’s Registrar did not require producers to meet the November 30, 2020, registration deadline. The Registrar extended the deadline to January 31, 2021, to support producers with gathering the necessary information needed for registration, which included producers of single-use batteries to submit their 2019 supply data, producers of rechargeable batteries and producers of ITT/AV to submit their 2018 supply data as well as pay for their 2020 registry fees.

The September 30, 2021, deadline is for producers of single-use batteries to submit 2020 supply data, producers of rechargeable batteries and producers of ITT/AV to submit 2019 supply data, along with paying for their 2021 registry fees. The 2021 deadline was moved to September due to the development of the registry and the fees consultation.

Beginning 2022, the registration deadline for the battery annual supply report will be April 30 of every year.

-

As the Regulator responsible for enforcing regulations under the Resource Recovery and Circular Economy Act, 2016, the Registrar uses their discretion for when it is necessary to give registrants more time to collect the information needed for registration and/or reporting.

-

The Authority has migrated the data submitted by producers in the excel spreadsheet earlier in 2021 into the Registry.

When a producer gains access to their Batteries or ITT/AV account, they will notice the submission date for the 2020 report to be January 31, 2021. The Authority understands that this may not be the exact date that each individual producer submitted their data.

-

For the reporting period ending September 30, 2021, producers of batteries and ITT/AV are required to report the following:

If you are a producer of ITT/AV, you are required to report:

- The weight of ITT/AV supplied in 2019

- If applicable, the weight of post-consumer recycled content or products eligible for a reduction in management requirement (outlined in the EEE Verification and Audit Procedure) supplied in Ontario for 2019

To learn what specific ITT/AV are required to be reported, read our Compliance Bulletin What ITT/AV needs to be reported?

If you are a producer of single-use batteries, you are required to report:

- The weight of single-use batteries supplied in 2020

- If applicable, the weight (if any), of post-consumer recycled content contained in the batteries supplied in Ontario for 2020

If you are a producer of rechargeable batteries, you are required to report:

- The weight of rechargeable batteries supplied in 2019

- If applicable, the weight of post-consumer recycled content contained in the batteries supplied in Ontario for 2019

You can use our weight conversion factor to determine weights, in which case you will need to determine the number of units sold into Ontario for each applicable material. For more information, visit our Battery Verification and Audit Procedure.

To learn what specific batteries are required to be reported, read our Compliance Bulletin What batteries need to be reported?

-

RPRA does not vet PROs before listing them on the website. Any business that registers as a PRO will be listed. Producers should do their own due diligence when determining which PRO to work with.

-

Account Admins must add any new, or manage existing, Primary Contacts under the program they wish to give them access to in order for the Primary Contact to be able to submit a report (e.g., permissions to view and complete reports).

To Manage contacts on your Registry account, please see the following steps:

- Log into your account

- Once you are logged in, click on the drop-down arrow in the top right corner and select Manage Users

- Under Actions, click Manage to update preferences of existing users

- Click Add New User to add an additional contact to your account

- To give reporting access to a Primary Contact, select the program from the drop-down that you would like to grant them access to

-

In determining whether an obligated producer used best efforts to meet their management requirements, the Compliance Team will consider whether the producer, acting in good faith, took all reasonable steps to meet the requirements outlined in the applicable regulation.

For example, best efforts in the context of management requirements may involve a producer regularly monitoring the volume of material being collected and managed, and implementing plans for increasing those volumes if the requirements are unlikely to be met.

Producers can contact the Compliance Team to ask specific questions about fulfilling their obligations.

-

A producer can grant access to anyone they would like to authorize in their reporting (i.e. Registry) portal. Producer reporting must be done in the producer account and batch data transfers are not accepted.

-

If a producer misreports their supply data to RPRA, they must contact the Compliance and Registry Team immediately by emailing registry@rpra.ca. Please include the following information in the email:

- The rationale for the change in the data

- Any data that supports the need for a correction (e.g., sales documents, audit)

- Any other information to support the change

While it is an offence to submit false or misleading information under the RRCEA, RPRA wants this corrected as quickly to ensure a producer’s minimum management requirement is calculated using accurate supply data.

RPRA can only receive these requests from the primary contact on the company’s Registry account. Your request for an adjustment will be reviewed by a Compliance and Registry Officer.

-

No, only producers are required to pay RPRA program fees. The decision to make producers pay fees and cover the Authority’s costs was made to reflect the fact that the Resource Recovery and Circular Economy Act, 2016 (RRCEA) is based on a producer responsibility framework. Although producers may hire service providers to help meet their obligations, the responsibility remains with the producer.

-

Under the Batteries, EEE, HSP, and Tire Regulations, a consumer is any end user of a product. A consumer includes an individual who obtains the product for the individual’s own use and a business that obtains the product for the business’s own use.

See our FAQ to understand “Who is a consumer under the Blue Box Regulation?”

-

test faq test

-

test answer