Frequently Asked Questions

Results (30)

Click the question to read the answer.

-

Under the Batteries, EEE, HSP, and Tire Regulations, a consumer is any end user of a product. A consumer includes an individual who obtains the product for the individual’s own use and a business that obtains the product for the business’s own use.

See our FAQ to understand “Who is a consumer under the Blue Box Regulation?”

-

No, transport packaging is only obligated when supplied to a consumer in Ontario. Any transport packaging removed by a retailer or other entity before the product is supplied to a consumer is not obligated under this regulation.

-

Businesses have the choice to recover the cost of recycling their products by incorporating those costs into the overall cost of their product (as they do with other costs, such as materials, labour, other regulatory compliance costs, etc.) or by charging it as a separate fee to consumers.

Environmental fees on batteries, electronics, hazardous and special products or tires are not mandatory and are applied at the discretion of the business charging them, including the amount of the fee.

-

Under the Blue Box Regulation, consumers are individuals who use a product and its packaging for personal, family or household purposes, or persons who use a beverage and its container for personal, family, household, or business purposes.

-

For the reporting period ending September 30, 2021, producers of batteries and ITT/AV are required to report the following:

If you are a producer of ITT/AV, you are required to report:

- The weight of ITT/AV supplied in 2019

- If applicable, the weight of post-consumer recycled content or products eligible for a reduction in management requirement (outlined in the EEE Verification and Audit Procedure) supplied in Ontario for 2019

To learn what specific ITT/AV are required to be reported, read our Compliance Bulletin What ITT/AV needs to be reported?

If you are a producer of single-use batteries, you are required to report:

- The weight of single-use batteries supplied in 2020

- If applicable, the weight (if any), of post-consumer recycled content contained in the batteries supplied in Ontario for 2020

If you are a producer of rechargeable batteries, you are required to report:

- The weight of rechargeable batteries supplied in 2019

- If applicable, the weight of post-consumer recycled content contained in the batteries supplied in Ontario for 2019

You can use our weight conversion factor to determine weights, in which case you will need to determine the number of units sold into Ontario for each applicable material. For more information, visit our Battery Verification and Audit Procedure.

To learn what specific batteries are required to be reported, read our Compliance Bulletin What batteries need to be reported?

-

See our FAQ to understand “What is blue box product packaging?”.

Product packaging added to a product can be added at any stage of the production, distribution and supply of the product. A person adds packaging to a product if they:

- make the packaging available for another person to add the packaging to the product

- cause another person to add the packaging to a product

- combine the product and the packaging

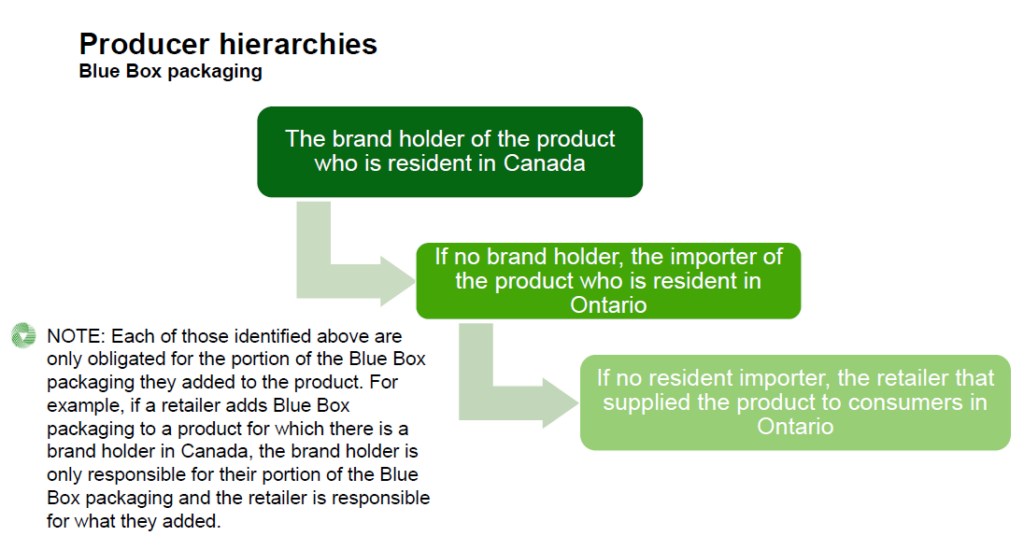

For the portion of the product packaging that a brand holder added to the product, a person is considered a producer:

- if they are the brand holder of the product and are resident in Canada

- if no resident brand holder, they are resident in Ontario and import the product

- if no resident importer, they are the retailer that supplied the product directly to consumers in Ontario

- if the retailer who would be the producer is a marketplace seller, the marketplace facilitator is the obligated producer

- if the producer is a business that is a franchise, the franchisor is the obligated producer, if that franchisor has franchisees that are resident in Ontario

For the portion of the product packaging that an importer of the product into Ontario added to the product, a person is considered a producer:

- if they are resident in Ontario and import the product

- if no resident importer, they are the retailer that supplied the product directly to consumers in Ontario

- if the retailer who would be the producer is a marketplace seller, the marketplace facilitator is the obligated producer

- if the producer is a business that is a franchise, the franchisor is the obligated producer, if that franchisor has franchisees that are resident in Ontario

For any portion of the packaging that is not described above, the producer is the retailer who supplied the product to consumers in Ontario.

-

A person is considered a producer under the HSP Regulation if they supply oil filters, oil containers, antifreeze, solvents, paints and coatings, pesticides, fertilizers, pressurized containers or refillable propane containers and:

- are the brand holder and has residency in Canada

- import from outside Ontario and has residency in Ontario

- markets directly to consumers in Ontario (e.g., online sales) and has residency in Ontario

- markets directly to consumers and does not have residency in Ontario

A person is considered a producer under the HSP Regulation if they supply mercury-containing barometers, thermometers or thermostats and:

- are the brand holder and has residency in Canada

- are the Brand holder of barometers, thermometers or thermostats marketed to consumers in Ontario that do not contain mercury

A person is considered a producer under the HSP Regulation if they supply fertilizers and:

- are the brand holder and has residency in Canada

Even if you do not meet the above definitions, there may be circumstances where you qualify as a producer. Read the HSP Regulation for more detail or contact the Compliance and Registry Team at registry@rpra.ca or (647) 496-0530 or toll-free at (833) 600-0530.

-

No. Section 68 subsection (3) of the Resource Recovery and Circular Economy Act states that “a person responsible for establishing and operating a collection system shall ensure that no charge is imposed at the time of the collection.”

-

New tires are supplied into Ontario in two ways – on new vehicles or as loose tires. In both cases, section 3 of the Tires Regulation defines tire producers in accordance with a hierarchy based on residency in Ontario, which means a person having a permanent establishment in Ontario within the meaning of the Corporations Tax Act:

For new loose tires that are marketed to consumers in Ontario

For new tires in Ontario: you are the producer for those new tires if you are the brand holder of the new tires (the legislation defines brand holder to mean a person who owns or licenses a brand or who otherwise has rights to market a product under the brand) and resident in Ontario.For new tires where there is no brand holder resident in Ontario: you are the producer for the new tires if you are the importer of those new tires and resident in Ontario.

For new tires where there is no brand holder or importer resident in Ontario: you are the producer for the new tires if you are the first person to market those tires in Ontario and resident in Ontario.

For new tires where there is no brand holder, importer or marketer resident in Ontario: you are the producer for the new tires if you are the person that marketed those new tires and non-resident in Ontario.

For new vehicles with tires that are marketed to consumers in Ontario

For new vehicles in Ontario: you are the producer for the new tires on those new vehicles if you are the manufacturer of the vehicles (the legislation defines vehicle to include motor vehicles, muscular-powered equipment and trailers) and resident in Ontario.For new vehicles where there is no manufacturer resident in Ontario: you are the producer for the new tires on those new vehicles if you are the importer of those new vehicles and resident in Ontario.

For new vehicles where there is no manufacturer or importer resident in Ontario: you are the producer for the new tires on those new vehicles if you are the marketer of those new vehicles in Ontario and resident in Ontario.

For new vehicles where there is no manufacturer, importer or marketer resident in Ontario: you are the producer for the new tires on those new vehicles if you are the marketer of those new vehicles and non-resident in Ontario.

-

You are considered a battery producer under the Batteries Regulation if you market batteries into Ontario and meet the following requirements:

- Are the brand holder of the battery and have residency in Canada;

- If there is no resident brand holder, have residency in Ontario and import batteries from outside of Ontario;

- If there is no resident importer, have residency in Ontario and markets directly to consumers in Ontario (e.g., online sales); or

- If there is no resident marketer, does not have residency in Ontario and markets directly to consumers in Ontario (e.g., online sales).

Even if you do not meet the above definition, there may be circumstances where you qualify as a producer. Read the Batteries Regulation for more detail or contact the Compliance and Registry Team for guidance at registry@rpra.ca or (647) 496-0530 or toll-free at (833) 600-0530.

-

You are an information technology, telecommunications, audio-visual (ITT/AV) producer if you market ITT/AV into Ontario and:

- Are the brand holder of the EEE and have residency in Canada;

- If there is no resident brand holder, have residency in Ontario and import EEE from outside of Ontario;

- If there is no resident importer, have residency in Ontario and market directly to consumers in Ontario (e.g., online sales); or

- If there is no resident marketer, do not have residency in Ontario and market directly to consumers in Ontario (e.g., online sales).

Even if you do not meet the above definition, there may be circumstances where you qualify as a producer. Read the Electrical and Electronic Equipment Regulation for more detail or contact the Compliance and Registry Team for guidance at registry@rpra.ca or (647) 496-0530 or toll-free at (833) 600-0530.

-

There is no set environmental fee for any product. The amount of the fee charged is decided by the business and must reflect the actual cost of recycling that product.

The tires regulation has specific rules about how a visible fee is communicated to consumers, and how tire retailers and producers must document and report on their use of visible fees. Refer to the compliance bulletin Charging Tire Fees to Consumers for details.

-

A marketplace facilitator is a person who contracts with a marketplace seller to facilitate the supply of the marketplace seller’s products by:

- Owning or operating an online consumer-facing marketplace or forum in which the marketplace seller’s products are listed or advertised for supply and where offer and acceptance are communicated between a marketplace seller and a buyer (e.g., a website), and

- Providing for the physical distribution of a marketplace seller’s products to the consumer (e.g., storage, preparation, shipping of products).

Under the Blue Box Regulation, if a retailer (online or at a physical location) is determined to be the producer based on hierarchies, but they are a marketplace seller, the marketplace facilitator is the obligated producer. A marketplace seller is a person who contracts with a marketplace facilitator to supply its products.

-

Producers of all materials must provide the following information when registering:

- Name, contact information and Stewardship Ontario number (if applicable)

- Identify any PROs who they have retained (if applicable at time of registration)

- Name, contact information of the person who will be responsible for having the registration complete and up to date

Producers of oil filters, antifreeze, oil containers, pressurized containers, pesticides, solvents, paints and coatings must also provide:

- The total weight of each type of HSP that was supplied to consumers in Ontario in 2018, 2019 and 2020

- See the Hazardous and Special Products Verification and Audit Procedure for more information

Producers of fertilizers and refillable propane containers must provide:

- The date they first supplied the products to consumers in Ontario

-

Beginning October 1, 2021, producers are obligated to:

- establish and operate a promotion and education program starting in 2022

- provide information on their website about how consumers can use, share and properly dispose of fertilizer with local requirements

- create promotional and education materials that include:

- The website URL

- A description of how consumers can use, share and properly dispose of fertilizer

- solicit, consider feedback from, and make the promotional and education materials available to:

- Indigenous communities

- Municipal governments

- Retailers that supply fertilizers

- provide information to municipalities on innovative end-use options for fertilizers as an alternative to disposal

-

You are a Blue Box processor if you process Blue Box material that was supplied to a consumer in Ontario for the purposes of resource recovery.

For the purpose of resource recovery, processing includes, and is not limited to:

- Sorting

- Baling

- Paper and cardboard shredding

- Plastic reprocessing include grinding, washing, pelletizing, compounding, etc.

- Crushed glass reprocessing

- Aluminum and steel reprocessing

See our FAQs to understand “Who is a consumer under the Blue Box Regulation”.

-

Consumer protection laws in Ontario require that the purpose of a visible fee cannot be misrepresented. This means that if a business decides to charge an environmental fee on batteries, electronics or tires, the fee:

- must reflect the business’ actual cost of recycling the product; and

- cannot be presented as a government tax, a RPRA fee or something similar.

There are additional rules in the tires regulation about visible fees related to recycling tires. For information about the rules for charging recycling fees on tires, refer to the compliance bulletin Charging Tire Fees to Consumers.

-

Blue Box materials supplied to a business (e.g., the operators of a long-term care home) are not obligated, however, there are no deductions available for materials supplied to a consumer in an IC&I setting (e.g., a resident of a long-term care home).

Any Blue Box materials supplied to consumers in Ontario are obligated. Blue Box materials supplied to the IC&I sector are not obligated (except beverage containers which are obligated regardless of the sector supplied into).

-

Yes. Producers are required to, at a minimum, publish and clearly display the following information on their website:

- The locations of the producer’s tire collection sites, for each tire type, where consumers may return tires at no charge. (This can done by directing people to the Authority’s Find a Collection Site map)

- A description of any collection services provided by the producer that are available other than at a tire collection site.

- A description of the resource recovery activities engaged in by the producer in the course of managing the producer’s collected tires.

As a producer, you may also be retailer, you can choose to charge a fee on the sale of new tires in Ontario to recover the costs associated with end of life collection and management. If you choose to charge a fee, such as a resource recovery fee or a tire handling fee, it may be added to the price of the product, or charged as a visible fee. You must be honest about what the visible fee is for and the amount cannot be arbitrary. A visible fee cannot be referred to as a tax.

-

As a retailer, you may also be a producer and/or a collector, based on the definitions in the Tires Regulation.

Promotion and education requirements will have to be met under section 13 of the Tires Regulation, if you have a website. This includes clearly displaying on the website:

- that the consumer may return tires to the site at no charge, if the retailer is a collection site; or

- the locations of tire collection sites near each retail location, if the retailer is not a collection site

Retailers can choose whether to charge a fee on the sale of new tires in Ontario to recover the costs associated with end of life collection and management. If you choose to charge a fee, such as a resource recovery fee or a tire handling fee, it may be added to the price of the product or charged as a visible fee. Businesses must be honest about what the fee is for and the amount cannot be arbitrary. A visible fee cannot be referred to as a tax.

-

No. Producers and PROs working on their behalf must operate the collection systems they have established as required by the Regulation even after their requirements are met. If a consumer is refused permission to drop off materials at a registered collection site, they can contact the Compliance and Registry Team at registry@rpra.ca, 647-496-0530 or toll-free at 1-833-600-0530.

-

Individual Producer Responsibility (IPR) means that producers are responsible and accountable for collecting and managing their products and packaging after consumers have finished using them.

Under the regulation, producers are directly responsible and accountable for meeting mandatory collection and recycling requirements for end of life products. With IPR, producers have choice in how they meet their requirements. They can collect and recycle the products themselves, or contract with producer responsibility organizations (PROs) to help them meet their requirements.

-

Under the Blue Box Regulation, blue box product packaging includes:

- Primary packaging is for the containment, protection, handling, delivery and presentation of a product at the point of sale, including all packaging components, but does not include convenience packaging or transport packaging (e.g., film and cardboard used to package a 24-pack of water bottles and the label on the water bottle).

- Transportation packaging which is provided in addition to primary packaging to facilitate the handling or transportation of one or more products such as a pallet, bale wrap or box, but does not include a shipping container designed for transporting things by road, ship, rail or air.

- Convenience packaging includes service packaging and is used in addition to primary packaging to facilitate end users’ handling or transportation of one or more products. It also includes packaging that is supplied at the point of sale by food-service or other service providers to facilitate the delivery of goods and includes items such as bags and boxes that are supplied to end users at check out, whether or not there is a separate fee for these items.

- Service accessories are products supplied with a food or beverage product and facilitate the consumption of that food or beverage product and are ordinarily disposed of after a single use, whether or not they could be reused (e.g., a straw, cutlery or plate).

- Ancillary elements are integrated into packaging (directly hung or attached to packaging) and are intended to be consumed or disposed of with the primary packaging. Ancillary elements help the consumer use the product. Examples of ancillary packaging include a mascara brush forming part of a container closure, a toy on the top of candy acting as part of the closure, devices for measuring dosage that form part of a detergent container cap, or the pouring spout on a juice or milk carton.

-

Under the Blue Box Regulation, a packaging-like product is:

- ordinarily used for the containment, protection, handling, delivery, presentation or transportation of things

- ordinarily disposed of after a single use

- not used as packaging when it is supplied to the consumer

Packaging-like products include aluminum foil, a metal tray, plastic film, plastic wrap, wrapping paper, a paper bag, beverage cup, plastic bag, cardboard box or envelope, but does not include a product made from flexible plastic that is ordinarily used for the containment, protection, or handling of food, such as cling wrap, sandwich bags, or freezer bags.

If a producer is unsure whether or not their product is a packaging-like product, they can ask themselves the following questions to help determine whether the product is obligated to be reported under the Blue Box Regulation:

- Is the product actually packaging around a separate product?

- If yes, the product is not a packaging-like product. Instead, the product is considered blue box packaging and must be reported as blue box material. If no, continue to the next question.

- Is the product used for the containment, protection, handling, delivery, presentation or transportation of a thing(s)?

- If no, the product is not a packaging-like product. If yes, continue to the next question.

- Is the product typically disposed of after a single use (regardless if some may wash and reuse it)?

- If no, the product is not a packaging-like product. If yes, continue to the next question.

- Is the product made from flexible plastic that is for the containment, protection or handling of food?

- If yes, the product is not a packaging-like product. If no, the product is a packaging-like product and must be reported as blue box material.

If a producer is still unsure whether or not their product is a packaging-like product, they should contact the Compliance and Registry Team at 833-600-0530 or registry@rpra.ca.

-

See our FAQs to understand “What are paper products?” and “What are packaging-like products?”.

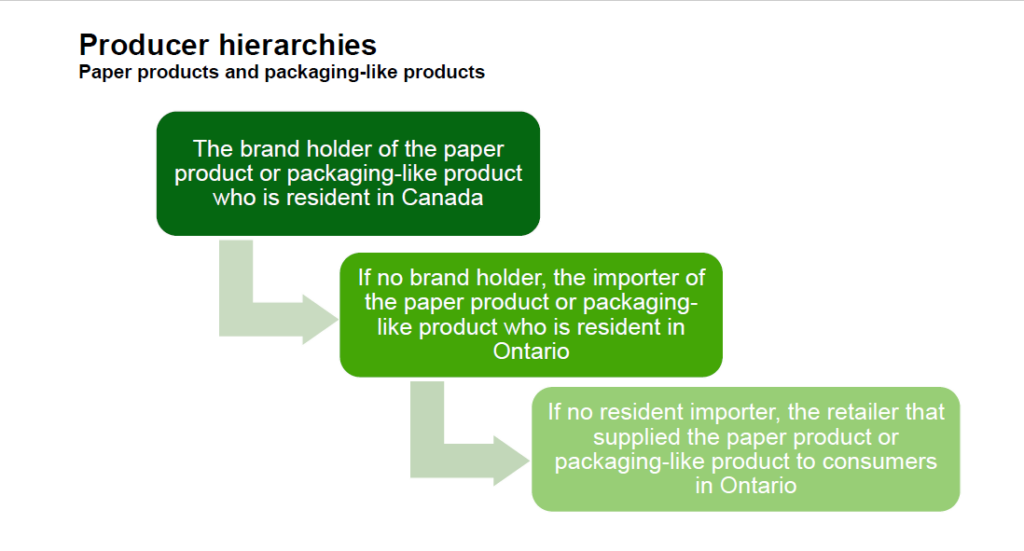

For paper products and packaging-like products, a person is considered a producer:

- if they are the brand holder of the paper product or packaging-like product and are resident in Canada

- if no resident brand holder, they are resident in Ontario and import the paper product or packaging-like product

- if no resident importer, they are the retailer that supplied the paper product or packaging-like product directly to consumers in Ontario

- if the retailer who would be the producer is a marketplace seller, the marketplace facilitator is the obligated producer

- if the producer is a business that is a franchise, the franchisor is the obligated producer, if that franchisor has franchisees that are resident in Ontario

-

The brand holder is the obligated producer.

A marketplace facilitator only becomes obligated for products supplied through its marketplace where the producer would have been a retailer. If the producer is a brand holder or an importer, they remain the obligated producer even when products are distributed by a marketplace facilitator.

A retailer is a business that supplies products to consumers, whether online or at a physical location.

-

A hauler is a person who arranges for the transport of HSP that are used by consumers in Ontario and are destined for processing, reuse, refurbishing or disposal, but does not include a person who arranges for the transport of HSP initially generated by that person

-

A processor is a person who processes, for the purpose of resource recovery, HSP used by consumers in Ontario

-

Beginning October 1, 2021, producers or PROs acting on their behalf, of mercury-containing devices are required to establish and operate a promotion and education program that:

- Promotes their collection and management services with respect to the type of HSP they are obligated for

- Provides the following information on a website with respect to that type of HSP:

- the presence of mercury in that type of HSP

- how to distinguish that type of HSP from similar products that do not contain mercury

- the hazards to human health and the environment related to mercury

- how consumers can properly dispose of that type of HSP

- a description of the collection services provided by the producer under this Regulation for that type of HSP

- a description of how the producer manages that type of HSP after it is collected under this Regulation

- Creates promotional and educational materials with respect to that type of HSP that include the following:

- the address of the website

- a description of how that type of HSP is collected and managed

- The producer shall make the promotional and educational materials available to retailers that supply that type of HSP or similar products that do not contain mercury, municipal governments, and Indigenous communities, and shall solicit and consider feedback from those retailers, municipal governments and Indigenous communities on how the promotional and educational materials can be improved

-

Producers of every type of HSP are required to keep records for a period of five years from the date of the record being created.

Producers must keep records that relate to the following:

- arranging for the establishment or operation of a collection or management system

- establishing or operating a collection or management system

- information required to be submitted to the Authority through the Registry

- implementing a promotion and education program

- weight of each type of HSP within each applicable category of HSP supplied to consumers in Ontario, regardless of whether information about the weight was required to be submitted to the Authority

- any agreements that relate to the above records