Frequently Asked Questions

Results (56)

Click the question to read the answer.

-

Here are the lists of registered PROs:

Hazardous and Special Products PROs

These lists will continue to be updated as new PROs register with RPRA.

-

If you are required to pay a fee during registration or when you are providing an annual data report for Batteries, Tires, and/or Electronics you can select from one of the following payment methods:

- Bank withdrawal (pre-authorized debit)

- Credit card

- Electronic data interchange (EDI)

- Electronic bill

- Cheque

If you are required to pay a fee during manual registration for Blue Box and/or Hazardous and Special Products, you can select from one of the following payment methods:

- Electronic data interchange (EDI)

- Electronic bill

- Cheque

Instructions for submitting your payment are provided during the registration process.

-

Yes. PROs are private enterprises and charge for their services to producers.

Each commercial contract a producer enters with a PRO will have its own set of terms and conditions. It is up to the PRO and producer to determine the terms of their contractual agreement, including fees and payment schedule.

RPRA does not set the terms of the contractual arrangements between PROs and producers.

-

No, producers are not required to sign up with a PRO to meet their regulatory requirements. It is a business decision if a producer chooses to work with a PRO, and a producer can choose to meet their obligations without a PRO.

Most producers will choose to contract with a PRO to provide collection, hauling, processing, retreading and/or refurbishing services to achieve their collection and management requirements unless they carry out these activities themselves.

-

Yes. Producers and service providers can enter into contractual agreements with multiple PROs.

-

Producers will be required to pay a program fee as part of the registration process, which supports the Authority’s operations. Program fees cover the Authority’s costs related to building and operating the electronic Registry, and compliance and enforcement activities.

For more information, refer to the 2022 RRCEA Program Fee Schedule for Batteries, Blue Box, ITT/AV, HSP, Lighting, and Tires.

-

Under the Resource Recovery and Circular Economy Act, the Authority is required to provide an annual report to the Minister that includes information on aggregate producer performance, and a summary of compliance and enforcement activities. Under section 51 of the Act, the Registrar also is required to post every order issued on the Registry.

-

A producer responsibility organization (PRO) is a business established to contract with producers to provide collection, management, and administrative services to help producers meet their regulatory obligations under the Regulation, including:

- Arranging the establishment or operation of collection and management systems (hauling, recycling, reuse, or refurbishment services)

- Establishing or operating a collection or management system

- Preparing and submitting reports

PROs operate in a competitive market and producers can choose the PRO (or PROs) they want to work with. The terms and conditions of each contract with a PRO may vary.

-

Individual Producer Responsibility (IPR) means that producers are responsible and accountable for collecting and managing their products and packaging after consumers have finished using them.

Under the regulation, producers are directly responsible and accountable for meeting mandatory collection and recycling requirements for end of life products. With IPR, producers have choice in how they meet their requirements. They can collect and recycle the products themselves, or contract with producer responsibility organizations (PROs) to help them meet their requirements.

-

The Authority is the regulator designated by law to oversee the operation and wind up of current waste diversion programs under the Waste Diversion Transition Act, 2016. The Authority provides oversight, compliance, and enforcement activities with respect to regulations made under the Resource Recovery and Circular Economy Act, 2016.

-

Under the Blue Box Regulation, blue box product packaging includes:

- Primary packaging is for the containment, protection, handling, delivery and presentation of a product at the point of sale, including all packaging components, but does not include convenience packaging or transport packaging (e.g., film and cardboard used to package a 24-pack of water bottles and the label on the water bottle).

- Transportation packaging which is provided in addition to primary packaging to facilitate the handling or transportation of one or more products such as a pallet, bale wrap or box, but does not include a shipping container designed for transporting things by road, ship, rail or air.

- Convenience packaging includes service packaging and is used in addition to primary packaging to facilitate end users’ handling or transportation of one or more products. It also includes packaging that is supplied at the point of sale by food-service or other service providers to facilitate the delivery of goods and includes items such as bags and boxes that are supplied to end users at check out, whether or not there is a separate fee for these items.

- Service accessories are products supplied with a food or beverage product and facilitate the consumption of that food or beverage product and are ordinarily disposed of after a single use, whether or not they could be reused (e.g., a straw, cutlery or plate).

- Ancillary elements are integrated into packaging (directly hung or attached to packaging) and are intended to be consumed or disposed of with the primary packaging. Ancillary elements help the consumer use the product. Examples of ancillary packaging include a mascara brush forming part of a container closure, a toy on the top of candy acting as part of the closure, devices for measuring dosage that form part of a detergent container cap, or the pouring spout on a juice or milk carton.

-

Under the Blue Box Regulation, paper products include printed and unprinted paper, such as a newspaper, magazine, greeting cards, calendars (promotional or purchased), notebooks and daily planners, promotional material, directory, catalogue or paper used for copying, writing or any other general use.

Hard or soft cover books and hardcover periodicals are not considered paper products.

-

Under the Blue Box Regulation, a packaging-like product is:

- ordinarily used for the containment, protection, handling, delivery, presentation or transportation of things

- ordinarily disposed of after a single use

- not used as packaging when it is supplied to the consumer

Packaging-like products include aluminum foil, a metal tray, plastic film, plastic wrap, wrapping paper, a paper bag, beverage cup, plastic bag, cardboard box or envelope, but does not include a product made from flexible plastic that is ordinarily used for the containment, protection, or handling of food, such as cling wrap, sandwich bags, or freezer bags.

If a producer is unsure whether or not their product is a packaging-like product, they can ask themselves the following questions to help determine whether the product is obligated to be reported under the Blue Box Regulation:

- Is the product actually packaging around a separate product?

- If yes, the product is not a packaging-like product. Instead, the product is considered blue box packaging and must be reported as blue box material. If no, continue to the next question.

- Is the product used for the containment, protection, handling, delivery, presentation or transportation of a thing(s)?

- If no, the product is not a packaging-like product. If yes, continue to the next question.

- Is the product typically disposed of after a single use (regardless if some may wash and reuse it)?

- If no, the product is not a packaging-like product. If yes, continue to the next question.

- Is the product made from flexible plastic that is for the containment, protection or handling of food?

- If yes, the product is not a packaging-like product. If no, the product is a packaging-like product and must be reported as blue box material.

If a producer is still unsure whether or not their product is a packaging-like product, they should contact the Compliance and Registry Team at 833-600-0530 or registry@rpra.ca.

-

As the Regulator responsible for enforcing regulations under the Resource Recovery and Circular Economy Act, 2016, the Registrar uses their discretion for when it is necessary to give registrants more time to collect the information needed for registration and/or reporting.

-

See our FAQ to understand “What is blue box product packaging?”.

Product packaging added to a product can be added at any stage of the production, distribution and supply of the product. A person adds packaging to a product if they:

- make the packaging available for another person to add the packaging to the product

- cause another person to add the packaging to a product

- combine the product and the packaging

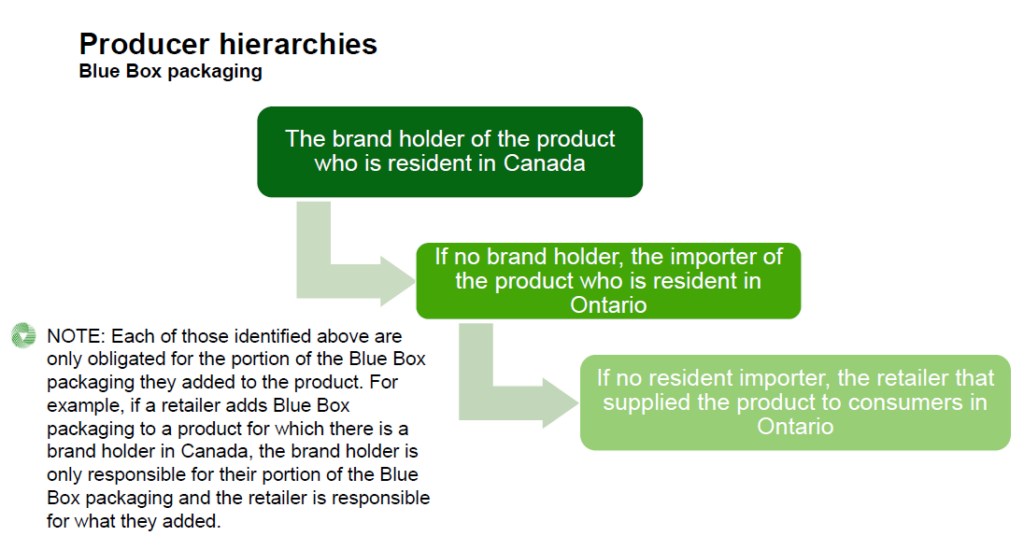

For the portion of the product packaging that a brand holder added to the product, a person is considered a producer:

- if they are the brand holder of the product and are resident in Canada

- if no resident brand holder, they are resident in Ontario and import the product

- if no resident importer, they are the retailer that supplied the product directly to consumers in Ontario

- if the retailer who would be the producer is a marketplace seller, the marketplace facilitator is the obligated producer

- if the producer is a business that is a franchise, the franchisor is the obligated producer, if that franchisor has franchisees that are resident in Ontario

For the portion of the product packaging that an importer of the product into Ontario added to the product, a person is considered a producer:

- if they are resident in Ontario and import the product

- if no resident importer, they are the retailer that supplied the product directly to consumers in Ontario

- if the retailer who would be the producer is a marketplace seller, the marketplace facilitator is the obligated producer

- if the producer is a business that is a franchise, the franchisor is the obligated producer, if that franchisor has franchisees that are resident in Ontario

For any portion of the packaging that is not described above, the producer is the retailer who supplied the product to consumers in Ontario.

-

See our FAQs to understand “What are paper products?” and “What are packaging-like products?”.

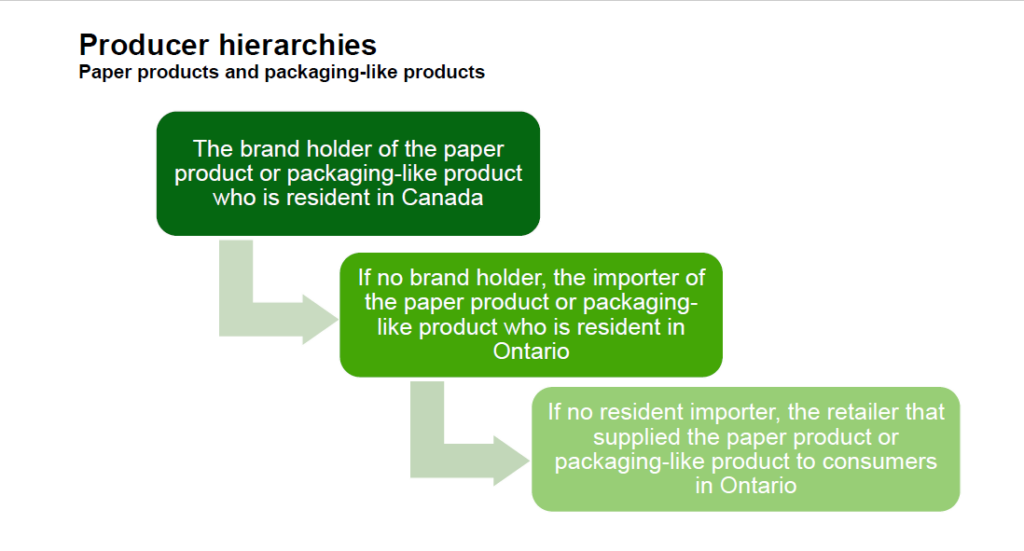

For paper products and packaging-like products, a person is considered a producer:

- if they are the brand holder of the paper product or packaging-like product and are resident in Canada

- if no resident brand holder, they are resident in Ontario and import the paper product or packaging-like product

- if no resident importer, they are the retailer that supplied the paper product or packaging-like product directly to consumers in Ontario

- if the retailer who would be the producer is a marketplace seller, the marketplace facilitator is the obligated producer

- if the producer is a business that is a franchise, the franchisor is the obligated producer, if that franchisor has franchisees that are resident in Ontario

-

No, transport packaging is only obligated when supplied to a consumer in Ontario. Any transport packaging removed by a retailer or other entity before the product is supplied to a consumer is not obligated under this regulation.

-

No, products or packaging designated as Hazardous and Special Products (HSP) are not obligated under the Blue Box Regulation. For example, primary packaging for paints and coatings are HSP and therefore not obligated as Blue Box materials.

Some packaging for HSP products may still be obligated. For example, the packaging that contains an oil filter is obligated as Blue Box materials.

Consult the HSP Regulation or the Compliance and Registry Team for further information.

-

The brand holder is the obligated producer.

A marketplace facilitator only becomes obligated for products supplied through its marketplace where the producer would have been a retailer. If the producer is a brand holder or an importer, they remain the obligated producer even when products are distributed by a marketplace facilitator.

A retailer is a business that supplies products to consumers, whether online or at a physical location.

-

Blue Box materials supplied to a business (e.g., the operators of a long-term care home) are not obligated, however, there are no deductions available for materials supplied to a consumer in an IC&I setting (e.g., a resident of a long-term care home).

Any Blue Box materials supplied to consumers in Ontario are obligated. Blue Box materials supplied to the IC&I sector are not obligated (except beverage containers which are obligated regardless of the sector supplied into).

-

Yes, producers are legally required to register and report to RPRA. Additionally, there are some differences between what materials were reported to Stewardship Ontario and what must now be reported to RPRA. Differences include:

- Newly obligated materials

- Brand holder in Canada now obligated (rather than Ontario)

- Producer must report total supply, and then report any weight to be deducted separately.

The producer registration form has a reporting table to facilitate the use of data that was previously reported to Stewardship Ontario, but producers must ensure that data reported to Stewardship Ontario is accurate supply data under the new regulation.

During transition years, stewards will be obligated and have to meet their requirements (e.g., reporting to Stewardship Ontario) under the Blue Box Program Plan and the WDTA and required to meet their obligations under the new Blue Box Regulation under the RRCEA, which includes registering, reporting and paying their Registry fee to RPRA.

-

RPRA does not vet PROs before listing them on the website. Any business that registers as a PRO will be listed. Producers should do their own due diligence when determining which PRO to work with.

-

Sections 54 and 55 of the Blue Box Regulation require municipalities and First Nations to submit the information in the Initial Report and Transition Report to the Authority.

Under the Blue Box Regulation, producers will be fully responsible for the collection and management of Blue Box materials that are supplied into Ontario. To ensure that all communities continue to receive Blue Box collection services, communities will be allocated to producers, or PROs on their behalf, who are obligated to provide collection services. The information that is submitted in the Initial and Transition Reports will be used by PROs to plan for collection in each eligible community.

The Authority will also use the information provided by municipalities and First Nations to ensure that producers are complying with their collection obligations under the Blue Box Regulation.

It is important that municipalities and First Nations complete these reports accurately so that all eligible sources (residences, facilities, and public spaces) in their communities continue to receive Blue Box collection after their community transitions to full producer responsibility.

-

There are three reports for eligible communities under the Blue Box Regulation: an Initial Report, a Transition Report and Change Reports.

- The Initial Report will be submitted by all communities in 2021. It will provide an overview of the communities and of the WDTA Blue Box program that operates in that community.

- The Transition Report will be submitted by communities 2 years prior to their transition year. It provides more detailed information about the WDTA Blue Box program that operates in the community.

- Change Reports will be used by communities when there are changes to the information that they submitted in either the Initial Report or Transition Report. At this time, the requirements and formats for change reports have not yet been established. RPRA will provide guidance in the future.

These reports need to be completed by all eligible communities under the Blue Box Regulation.

An eligible community is a local municipality or local services board area that is not located in the Far North, or a reserve that is registered by a First Nation with the Authority and not located in the Far North.

- The Far North has the same meaning as in the Far North Act, 2010. To determine whether a community is in the Far North, use this link.

- A local municipality means a single-tier municipality or a lower-tier municipality. A local services board has the same meaning as “Board” in the Northern Services Boards Act.

- A First Nation means a council of the Band as referred to in subsection 2(1) of the Indian Act (Canada).

If you are an upper-tier municipality or waste association, these reports must be submitted separately for each eligible community in your program.

Visit the Municipal and First Nation webpages for more information.

-

Yes, all eligible communities must submit these reports to the Authority. The Datacall is the source of data for determining the net Blue Box system cost and for allocating funding under the Blue Box Program Plan. The Initial and Transition reports are for a separate and distinct program than Datacall and are required under the new Blue Box Regulation, which requires eligible communities to submit these reports.

While some of the required information in these reports was reported to Datacall, much of the information was not. Where there is overlap between what was reported to Datacall and the information that is required in these reports, please see the guidance below on where to find this information in your Datacall report.

-

First Nation communities interested in receiving producer-run Blue Box services must register with the Authority. To register, communities must submit contact information of the person responsible for waste management in the community using the First Nation community registration form. Once completed, the registration form should be submitted by email to registry@rpra.ca.

Visit our First Nation webpage for more information.

-

Under the Blue Box Regulation, consumers are individuals who use a product and its packaging for personal, family or household purposes, or persons who use a beverage and its container for personal, family, household, or business purposes.

-

A marketplace facilitator is a person who contracts with a marketplace seller to facilitate the supply of the marketplace seller’s products by:

- Owning or operating an online consumer-facing marketplace or forum in which the marketplace seller’s products are listed or advertised for supply and where offer and acceptance are communicated between a marketplace seller and a buyer (e.g., a website), and

- Providing for the physical distribution of a marketplace seller’s products to the consumer (e.g., storage, preparation, shipping of products).

Under the Blue Box Regulation, if a retailer (online or at a physical location) is determined to be the producer based on hierarchies, but they are a marketplace seller, the marketplace facilitator is the obligated producer. A marketplace seller is a person who contracts with a marketplace facilitator to supply its products.

-

As an obligated Blue Box producer, you are required to:

- Register with RPRA

- Report supply data to RPRA annually

- Meet mandatory and enforceable requirements for Blue Box collection systems

- Meet mandatory and enforceable requirements for managing collected Blue Box materials, including meeting a management requirement set out in the regulation

- Meet mandatory and enforceable requirements for promotion and education

- Provide third-party audits of actions taken towards meeting your collection and management requirements, and report on those actions to RPRA through annual performance reports

-

Yes, there have been some key changes to the producer hierarchies which may affect what a producer is obligated for and should be considered if using data previously reported to Stewardship Ontario:

- If a retailer is determined to be the producer based on hierarchies, but they are a marketplace seller, the marketplace facilitator is the obligated producer.

- Brand holders that are resident in Canada are obligated, which varies from the Stewardship Ontario program where brand holders that are resident in Ontario are obligated.

See our FAQ to understand “Who is a marketplace facilitator?”.

-

There is an exemption in the Blue Box Regulation for producers whose gross annual revenue generated from products and services in Ontario is less than $2 million. The revenue that counts towards the exemption is revenue from products and services. Government tax revenue is not revenue from products and services and therefore does not count towards the exemption. Revenue other than tax revenue that is recorded by municipalities will be considered revenue from products and services.

-

There is an exemption in the Blue Box regulation for producers whose gross annual revenue generated from products and services in Ontario less than $2 million. The revenue that counts towards the exemption is revenue from products and services. Charitable donations are not revenue from products and services and therefore does not count towards the exemption. Revenue other than charitable donations that are recorded from registered charities will be considered revenue from products and services.

-

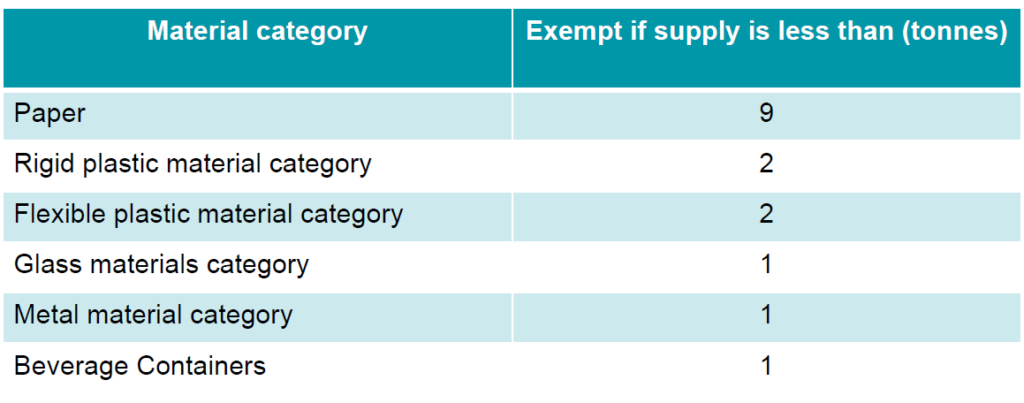

Yes. Exemptions are based on a producer’s annual revenue and how much they supply per material category.

-

- Any producer whose gross annual Ontario revenue from products and services is less than $2,000,000 is exempt from all producer requirements under the regulation.

- Any producer who meets the exemption must keep any records that demonstrate its gross annual Ontario revenue is less than $2,000,000 in a paper or electronic format and can be examined or accessed in Ontario for a period of five years from the date of creation.

Producers can also be exempt from having management requirements for a material category based on their supply in that category

There are three exemption scenarios for producers:

- If the producer’s annual revenue is less than $2 million, they are required to maintain records only

- If annual revenue is more than $2 million, and supply weight in all material categories is less than the tonnage exemption threshold, producers are required to register and report

- If annual revenue is more than $2 million, and supply weight in at least one material category is above the tonnage exemption threshold, producers are required to meet all obligations (registration, reporting, collection, management, and promotion and education). However, producers are only required to meet their management requirement in material categories where they are above the exemption level.

See our FAQ to understand what revenues municipalities and registered charities should consider when determining whether or not they are an exempt producer.

-

-

The following are the types of Blue Box Materials obligated under the Blue Box Regulation:

- Blue box packaging (primary, transport, convenience, service accessories, ancillary elements)

- Paper products

- Packaging-like products

-

Yes, there are several newly obligated packaging/products under the Blue Box Regulation, including:

- Unprinted paper

- Packaging-like products, such as aluminum foil, metal trays, wrapping paper, paper bags, cardboard boxes and envelopes

- Service accessories, such as straws, cutlery or plates that are supplied with a food or beverage product

- Durable products, such as CD cases, box board for board games/puzzles and power tool cases

Note: Another change is that beverage containers are obligated regardless of the sector they are supplied into (personal, family, household, or business purposes).

-

Producers must complete this Registration Form and email it as an attachment to registry@rpra.ca on or before October 1, 2021. After this date, new businesses are required to register within 30 days of becoming a producer.

For more information, please visit our Blue Box Producer webpage.

-

Producers are required to register with RPRA by October 1, 2021, as outlined in the Blue Box Regulation.

After this date, new businesses are required to register within 30 days of becoming a producer.

-

Producers are required to provide the following information when registering with RPRA:

- Contact information

- PRO information (if a PRO has been retained at time of reporting), including what services they have retained a PRO for

- Their 2020 supply data in each of the seven material categories– beverage container, glass material, flexible plastic, metal material, paper material, and certified compostable products and packaging material – as well as any deductions.

Please note that this information must be submitted to RPRA directly.

See our FAQ to understand “What deductions are available to producers under the Blue Box Regulation?”

-

Starting in 2022, producers are required to report their supply data annually to RPRA.

Each year, producers will need to provide the previous years’ supply data in each of the seven material categories – beverage container, glass material, flexible plastic, rigid plastic, metal material, paper material, and certified compostable products and packaging material – as well as any deductions.

See our FAQ to understand “What deductions are available to producers under the Blue Box Regulation?”

-

RPRA’s Registry fees cover the costs related to compliance and enforcement and other activities required to administer the regulations under the RRCEA, and building and operating the Registry.

The Registry fees cover expenses in a given year (e.g., 2021 fees cover 2021 expenses). 2021 fees for Blue Box cover the Authority’s costs to undertake activities to implement the regulation in 2021, which include:

- helping obligated parties understand their requirements

- ensuring producers register and report their supply data by the deadline in the regulation

- compliance, enforcement, and communication activities

-

Allowable deductions are those Blue Box materials that are:

- deposited into a receptacle at a location that is:

- not an eligible source, and

- where the product related to the Blue Box material was supplied and used or consumed (e.g., a fast-food restaurant)

- collected from an eligible source at the time a related product was installed or delivered (e.g., packaging that is removed from the house by a technician installing a new appliance).

The weight of Blue Box material in each material category to be deducted must be reported separately.

There are no other deductions available to producers under the Blue Box Regulation.

- deposited into a receptacle at a location that is:

-

Yes, there are some key changes to the data reported to Stewardship Ontario and what needs to be reported under the new regulation, which may affect what a producer is obligated for and should be considered if using data previously reported to Stewardship Ontario:

- There are fewer reporting categories than under the Stewardship Ontario program

- Certified compostable packaging and products now must be reported separately, but this category does not have management requirements

- There are only two deductions permitted under the Blue Box Regulation, and producers must report total supply and then report any weight to be deducted separately

- Exemptions are based on tonnage supply under each material category instead of a total supply weight threshold of less than 15 tonnes as in Stewardship Ontario’s program

See our FAQ to understand “What deductions are available to producers under the Blue Box Regulation?”; “Are there exemptions for Blue Box producers?“; “Are there any differences in Blue Box producer hierarchies between the current Stewardship Ontario program and the new Blue Box Regulation?”; and “Are there are any differences in obligated Blue Box materials between the current Stewardship Ontario program and the new Blue Box Regulation?”

-

The rule and allocation table creation process has been removed from the Blue Box Regulation and is therefore no longer required to create and maintain the system for collecting Blue Box materials across the province, as per regulatory amendments made by the government on April 14, 2022. As such, rule creators are no longer applicable under the regulation. Learn more about the amendments.

To replace these tools, the amended regulation now requires PROs to submit a report that outlines how they will operate the Blue Box collection system on behalf of producers, ensuring that materials are collected from all eligible communities (i.e., communities outside of the Far North) across the province. Learn more about what PROs need to include in the report.

-

Yes, a producer can change PROs at any time. Producers must notify RPRA of any change in PROs within 30 days of the change.

-

In determining whether an obligated producer used best efforts to meet their management requirements, the Compliance Team will consider whether the producer, acting in good faith, took all reasonable steps to meet the requirements outlined in the applicable regulation.

For example, best efforts in the context of management requirements may involve a producer regularly monitoring the volume of material being collected and managed, and implementing plans for increasing those volumes if the requirements are unlikely to be met.

Producers can contact the Compliance Team to ask specific questions about fulfilling their obligations.

-

Under the Blue Box Regulation, allowable deductions for producers include Blue Box materials that are deposited into a receptacle at a location that is not an eligible source and where the product related to the Blue Box material was supplied and used or consumed.

This applies to food court restaurants located in a mall or in the base of an office tower. Blue Box materials that were disposed of in the buildings’ recycling receptacles and were supplied and used or consumed within that physical building are an allowable deduction. Blue Box materials that were disposed of in the buildings’ recycling receptacles but were not supplied and used or consumed within that physical building are not deductible.

This does not reduce the obligation of a producer to provide complete and accurate supply data or limit the ability of an Authority inspector to review the data and related records for the purpose of determining compliance.

-

An electronic Blue Box Registry will be used for 2022 producer reporting (2021 data).

The electronic Blue Box Registry for reporting is currently being developed and will be made available in Q4 2022.

-

A producer can calculate their management requirements independently with their supply data outside the Registry.

-

A producer can grant access to anyone they would like to authorize in their reporting (i.e. Registry) portal. Producer reporting must be done in the producer account and batch data transfers are not accepted.

-

The regulation requires that each eligible source is allocated to a single producer, or group of producers represented by the same PRO. The rules will determine the methodology for assigning eligible sources to producers/PROs. PROs share liability with producers for performance.

-

If a producer misreports their supply data to RPRA, they must contact the Compliance and Registry Team immediately by emailing registry@rpra.ca. Please include the following information in the email:

- The rationale for the change in the data

- Any data that supports the need for a correction (e.g., sales documents, audit)

- Any other information to support the change

While it is an offence to submit false or misleading information under the RRCEA, RPRA wants this corrected as quickly to ensure a producer’s minimum management requirement is calculated using accurate supply data.

RPRA can only receive these requests from the primary contact on the company’s Registry account. Your request for an adjustment will be reviewed by a Compliance and Registry Officer.

-

You are a Blue Box processor if you process Blue Box material that was supplied to a consumer in Ontario for the purposes of resource recovery.

For the purpose of resource recovery, processing includes, and is not limited to:

- Sorting

- Baling

- Paper and cardboard shredding

- Plastic reprocessing include grinding, washing, pelletizing, compounding, etc.

- Crushed glass reprocessing

- Aluminum and steel reprocessing

See our FAQs to understand “Who is a consumer under the Blue Box Regulation”.

-

No, only producers are required to pay RPRA program fees. The decision to make producers pay fees and cover the Authority’s costs was made to reflect the fact that the Resource Recovery and Circular Economy Act, 2016 (RRCEA) is based on a producer responsibility framework. Although producers may hire service providers to help meet their obligations, the responsibility remains with the producer.

-

Processors need to provide the following information when registering with the Authority:

- Business information (e.g., business name, contact information)

- Processing site location, contact information and Blue Box materials received and processed at each location

- Any producers or PROs the processor has contracted with

Visit our Blue Box Processors webpage for more information.

-

No. If your business does not conduct resource recovery activities as its primary purpose, there is no requirement to register as a processor with the Authority.

-

RPRA considers an aerosol container to be a non-refillable receptacle that contains a product and a propellant under pressure, and that is fitted with a release device allowing the contents to be ejected as solid or liquid particles in suspension in a gas, or as a foam, paste, powder, liquid, or gas.