Frequently Asked Questions

Results (26)

Click the question to read the answer.

-

The Batteries Regulation applies to the following types of batteries sold separately in Ontario (e.g., not embedded in products):

- Single-use (primary) batteries weighing 5 kg or less and sold separately from products; and

- Rechargeable batteries weighing 5 kg or less and sold separately from products.

Examples of single-use and rechargeable batteries that fall under the Batteries Regulation are button cells, AA, AAA, C, D, 9V, lantern batteries, sealed lead-acid batteries, and replacement batteries for products (for example, drill, cell phone, laptop) that weigh under 5 kg or less.

The regulation does not apply to the following:

- Batteries sold with or in products (for example, batteries sold with or in drills, cell phones, laptops, toys, vapes, fire alarms); or

- Batteries over 5 kg (for example, car batteries, forklift batteries, stationary batteries).

For more information, see the Compliance Bulletin: What batteries have to be reported?

If you have questions about what items are and are not covered under the Batteries Regulation, contact the Compliance and Registry Team at registry@rpra.ca or (647) 496-0530 or toll-free at (833) 600-0530.

-

To calculate Blue Box P&E admin staff costs there are several steps:

- Determine total admin costs (salary, benefits, etc.) for promotion and education related to waste management and enter it in the first column

- Determine this cost based on the number of hours spent on P&E, not the total number of total hours for this position

- Determine the ratio of the number of hours of Blue Box specific P&E activities versus total number of hours of P&E for waste management

- Convert this ratio of hours to a percent and enter it in the second column

- Determine total admin costs (salary, benefits, etc.) for promotion and education related to waste management and enter it in the first column

-

First the Steward Obligation, InKind and Continuous Improvement (CIF) amounts are determined and then the funding is allocated for each municipal program in the MFAM (Municipal Funding Allocation Model). The MFAM uses the following three factors to determine the funding amount for each municipal Blue Box program:

- Best Practices score from Section 2.4 (accounts for 15% of funding)

- Recovered Tonnage of Blue Box materials marketed (accounts for 35% of funding)

- Net Cost of Blue Box program (accounts for 50% of funding)

-

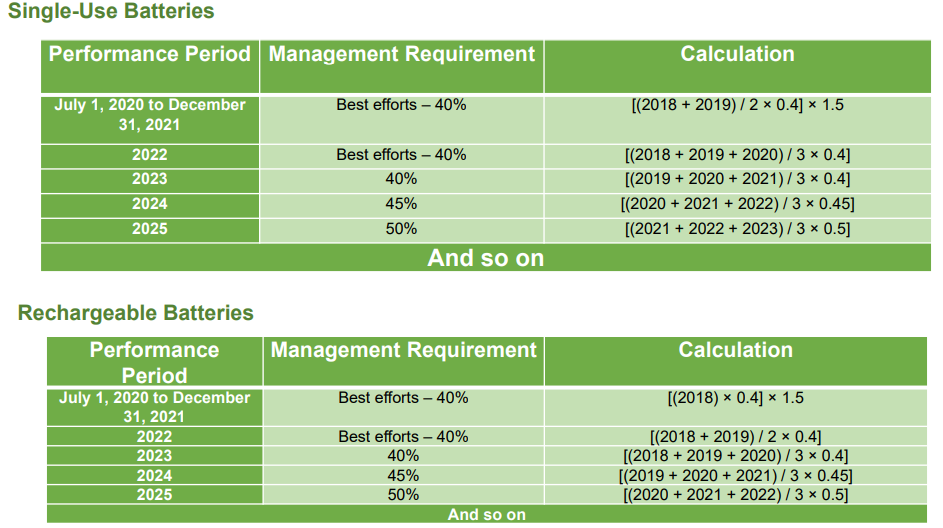

A producer’s individual management requirements are determined by the following formulas found in section 13 of the Regulation:

It is important to note that producer’s must ensure that all batteries collected are managed regardless of their minimum management requirement.

-

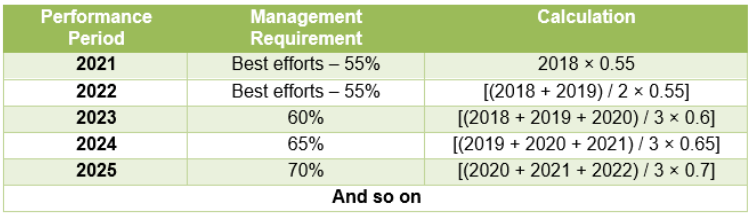

A producer’s individual management requirements are determined by the following formulas found in section 14 of the Regulation, summarized in the following chart:

It is important to note that producer’s must ensure that all ITT/AV collected is managed regardless of what their minimum management requirement is.

-

For the reporting period ending September 30, 2021, producers of batteries and ITT/AV are required to report the following:

If you are a producer of ITT/AV, you are required to report:

- The weight of ITT/AV supplied in 2019

- If applicable, the weight of post-consumer recycled content or products eligible for a reduction in management requirement (outlined in the EEE Verification and Audit Procedure) supplied in Ontario for 2019

To learn what specific ITT/AV are required to be reported, read our Compliance Bulletin What ITT/AV needs to be reported?

If you are a producer of single-use batteries, you are required to report:

- The weight of single-use batteries supplied in 2020

- If applicable, the weight (if any), of post-consumer recycled content contained in the batteries supplied in Ontario for 2020

If you are a producer of rechargeable batteries, you are required to report:

- The weight of rechargeable batteries supplied in 2019

- If applicable, the weight of post-consumer recycled content contained in the batteries supplied in Ontario for 2019

You can use our weight conversion factor to determine weights, in which case you will need to determine the number of units sold into Ontario for each applicable material. For more information, visit our Battery Verification and Audit Procedure.

To learn what specific batteries are required to be reported, read our Compliance Bulletin What batteries need to be reported?

-

A battery producer qualifies for an exemption if its management requirement is less than 1.25 tonnes of rechargeable batteries or less than 2.5 tonnes of single-use batteries. A producer’s management requirement is calculated as a percentage of the weight of batteries supplied into Ontario in a specific period. This calculation changes each year, and therefore producers should verify whether they qualify for an exemption annually.

For information about how to calculate your management requirement, refer to our FAQ, How are battery producer minimum management requirements determined?

A producer who meets the weight exemption and has five or more full-time employees does not have collection or management requirements but is required to register and report battery supply data to the Authority.

A producer who meets the weight exemption and has less than five full-time employees has no obligation under the Batteries Regulation.

Producers who want to confirm their status as an exempt producer should contact the Compliance Team at registry@rpra.ca or 833-600-0530.

-

Yes. PROs are private enterprises and charge for their services to producers.

Each commercial contract a producer enters with a PRO will have its own set of terms and conditions. It is up to the PRO and producer to determine the terms of their contractual agreement, including fees and payment schedule.

RPRA does not set the terms of the contractual arrangements between PROs and producers.

-

Tire Collection Requirements

The minimum tire collection requirements are calculated based on a rolling average of three years of tire supply data multiplied by 0.85 to account for tire wear. Section 4(2) of the Tires Regulation describes the formula used.Tire Resource Recovery Requirements

Producers must ensure that 85% of the tires they collected in a year, by weight, were reused, retreaded or turned into processed materials and made into products and packaging as described in section 11 of the Tires Regulation.Any producer who collects tires in a calendar year, despite being exempt from the collection requirements under section 4(7) of the Tires Regulation, is required to manage those tires (through reuse, retreading or processing) in accordance with section 11(6) of the Tires Regulation.

-

No. The Authority does not administer contracts or provide incentives. Under the Regulations, producers will either work with a producer responsibility organization (PRO) or work directly with collection sites, haulers, refurbisher’s and/or processors to meet their collection and management requirements. Any reimbursement for services provided towards meeting a producers’ collection and management requirements will be determined through commercial contracts.

To discuss any payment, contact your service provider or a PRO. RPRA does not set the terms of the contractual arrangements between PROs and producers.

-

Producer supply data is used to calculate their individual minimum management requirements under the Batteries Regulation.

To learn how calculations are formulated, visit the FAQ How are battery producer minimum management requirements determined?

-

Producer supply data is used to calculate their individual minimum management requirements under the EEE Regulation.

To learn how calculations are formulated, visit the FAQ How are ITT/AV producer minimum management requirements determined?

-

An ITT/AV producer qualifies for an exemption if its management requirement for a performance period is not more than 3.5 tonnes with respect to ITT/AV or not more than 350 kg with respect to lighting. The producer is exempt from the following:

- Registering and reporting to the Authority;

- Establishing a collection and management system and meeting a management requirement; and

- Promotion and education requirements.

The management requirement percentage increases each year in 2023, 2024, and 2025, therefore while you may be exempt in 2021 and 2022, you might not be exempt in subsequent years. Therefore, a producer must verify that they continue to meet the exemption each year.

If a producer is exempt and therefore not required to register with the Authority, they must retain records related to the weight of ITT/AV supplied into Ontario each year and provide them to the Authority upon request.

Producers are encouraged to confirm their exemption with the Compliance Team at 833-600-0530 or registry@rpra.ca.

-

You may have obligations as an ITT/AV producer. To determine if you are a producer, see the FAQ Am I an ITT/AV producer?

If you are not a producer, then under the EEE Regulation you are not required to report supply data to the Authority or anyone else.

-

No. The list of products obligated under the EEE Regulation is different from the list of products included in the OES Program. The OES Program required producers to report the number of units they supplied, while the EEE Regulation requires producers to report the total weight of products.

To help producers calculate the weight of their products, we have included weight conversion factors in our Verification and Audit procedure, which is included as a weight conversion tool on the registration form. Once a producer determines the units of products on which they are obligated to report, they can enter the units into the conversion tool to get a calculated weight to report to the Authority.

For more information, see the Determining Supply Data section of the Registry Procedure: EEE Verification and Audit.

-

If you are concerned about the fee you were charged, you should contact the business that charged you the fee to request a more detailed explanation of how the fee was determined.

If you are concerned about a tire handling fee, you can contact the Compliance and Registry Team at registry@rpra.ca and our team will review to ensure that the rules for charging tire fees were followed.

-

Under the Blue Box Regulation, a packaging-like product is:

- ordinarily used for the containment, protection, handling, delivery, presentation or transportation of things

- ordinarily disposed of after a single use

- not used as packaging when it is supplied to the consumer

Packaging-like products include aluminum foil, a metal tray, plastic film, plastic wrap, wrapping paper, a paper bag, beverage cup, plastic bag, cardboard box or envelope, but does not include a product made from flexible plastic that is ordinarily used for the containment, protection, or handling of food, such as cling wrap, sandwich bags, or freezer bags.

If a producer is unsure whether or not their product is a packaging-like product, they can ask themselves the following questions to help determine whether the product is obligated to be reported under the Blue Box Regulation:

- Is the product actually packaging around a separate product?

- If yes, the product is not a packaging-like product. Instead, the product is considered blue box packaging and must be reported as blue box material. If no, continue to the next question.

- Is the product used for the containment, protection, handling, delivery, presentation or transportation of a thing(s)?

- If no, the product is not a packaging-like product. If yes, continue to the next question.

- Is the product typically disposed of after a single use (regardless if some may wash and reuse it)?

- If no, the product is not a packaging-like product. If yes, continue to the next question.

- Is the product made from flexible plastic that is for the containment, protection or handling of food?

- If yes, the product is not a packaging-like product. If no, the product is a packaging-like product and must be reported as blue box material.

If a producer is still unsure whether or not their product is a packaging-like product, they should contact the Compliance and Registry Team at 833-600-0530 or registry@rpra.ca.

-

There are three reports for eligible communities under the Blue Box Regulation: an Initial Report, a Transition Report and Change Reports.

- The Initial Report will be submitted by all communities in 2021. It will provide an overview of the communities and of the WDTA Blue Box program that operates in that community.

- The Transition Report will be submitted by communities 2 years prior to their transition year. It provides more detailed information about the WDTA Blue Box program that operates in the community.

- Change Reports will be used by communities when there are changes to the information that they submitted in either the Initial Report or Transition Report. At this time, the requirements and formats for change reports have not yet been established. RPRA will provide guidance in the future.

These reports need to be completed by all eligible communities under the Blue Box Regulation.

An eligible community is a local municipality or local services board area that is not located in the Far North, or a reserve that is registered by a First Nation with the Authority and not located in the Far North.

- The Far North has the same meaning as in the Far North Act, 2010. To determine whether a community is in the Far North, use this link.

- A local municipality means a single-tier municipality or a lower-tier municipality. A local services board has the same meaning as “Board” in the Northern Services Boards Act.

- A First Nation means a council of the Band as referred to in subsection 2(1) of the Indian Act (Canada).

If you are an upper-tier municipality or waste association, these reports must be submitted separately for each eligible community in your program.

Visit the Municipal and First Nation webpages for more information.

-

A marketplace facilitator is a person who contracts with a marketplace seller to facilitate the supply of the marketplace seller’s products by:

- Owning or operating an online consumer-facing marketplace or forum in which the marketplace seller’s products are listed or advertised for supply and where offer and acceptance are communicated between a marketplace seller and a buyer (e.g., a website), and

- Providing for the physical distribution of a marketplace seller’s products to the consumer (e.g., storage, preparation, shipping of products).

Under the Blue Box Regulation, if a retailer (online or at a physical location) is determined to be the producer based on hierarchies, but they are a marketplace seller, the marketplace facilitator is the obligated producer. A marketplace seller is a person who contracts with a marketplace facilitator to supply its products.

-

Yes, there have been some key changes to the producer hierarchies which may affect what a producer is obligated for and should be considered if using data previously reported to Stewardship Ontario:

- If a retailer is determined to be the producer based on hierarchies, but they are a marketplace seller, the marketplace facilitator is the obligated producer.

- Brand holders that are resident in Canada are obligated, which varies from the Stewardship Ontario program where brand holders that are resident in Ontario are obligated.

See our FAQ to understand “Who is a marketplace facilitator?”.

-

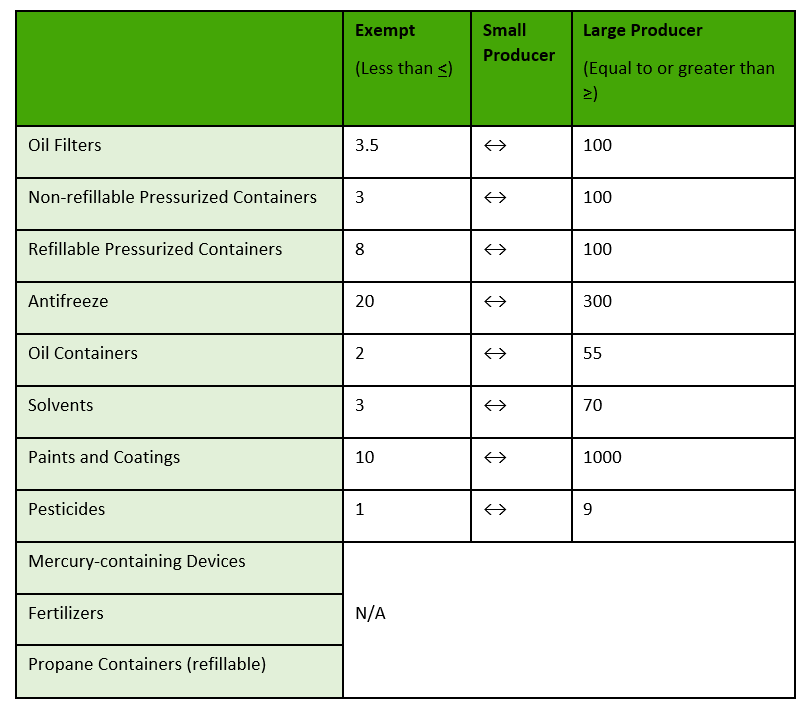

Producers can reference the following chart to determine if they are a small, large or exempt HSP producer. To calculate your average weight of supply to confirm that you are an exempt producer, reference the Registration Form.

Producer categories use the average weight of material (in tonnes) supplied in Ontario in the previous calendar year.

-

In determining whether an obligated producer used best efforts to meet their management requirements, the Compliance Team will consider whether the producer, acting in good faith, took all reasonable steps to meet the requirements outlined in the applicable regulation.

For example, best efforts in the context of management requirements may involve a producer regularly monitoring the volume of material being collected and managed, and implementing plans for increasing those volumes if the requirements are unlikely to be met.

Producers can contact the Compliance Team to ask specific questions about fulfilling their obligations.

-

The Short-form Datacall is a streamlined version of the Long-form Datacall developed for smaller municipalities. The Short-form Datacall has Section 3.3, and all of Section 5 removed. This means that eligible municipalities do not have to report any Non-Blue Box information. The Short-form Datacall still collects the necessary data for calculating the municipal program’s Blue Box funding (i.e. if a municipal program elects to complete the Short-form, their Blue Box funding will not be affected). Since Non-Blue Box sections are removed, the Authority will not calculate a diversion rate for municipal programs who report into the Short-form Datacall. If a municipal program would still like to receive a diversion rate, then they must report into the standard Datacall.

Through consultation with municipal programs and the Municipal Industry Program Committee (MIPC), a committee of the Authority’s, it was determined that municipal programs with populations of 30,000 or less may be eligible for the Short-form Datacall.

-

You may report expenditures for any of the Blue Box P&E materials that are listed in Section 2.3 of the Datacall. Remember to apply a percentage that accurately represents the portion of the materials related to the residential Blue Box program. Do not report any InKind advertising linage.

Note: Administration staff cost is for the administration of the P&E materials only, and not for the entire Blue Box program. It is important to keep good records on how the P&E allocations were determined in case of an audit, or if RPRA should request it.

-

Only residential Blue Box costs and tonnes are eligible for industry funding. Therefore, the portion of tonnes and costs from IC&I must be accounted for. There are different ways to calculate these allocations, including those listed below.

- For collection, IC&I allocations may be determined by dividing the number of IC&I stops on a collection route by the total number of stops. The number of IC&I stops as a ratio of total stops is a good indicator of costs for collection activities. This allocation may then be applied to all costs and/or tonnes reported in that contract.

- For Non-Blue Box allocations (e.g., if a truck co-collects Blue Box material and organics), costs must be apportioned to account for the collection of an additional waste stream.

- Allocations for processing costs may be based on tonnes. For instance, if a municipality owns a Material Recovery Facility (MRF) that processes Blue Box material from another municipality, the tonnes and costs related to that processing would have to be removed from the reported tonnes and costs.

- Depot costs may be handled in a similar manner, using the proportion of IC&I tonnes to remove ineligible costs. Alternatively, costs could be deducted according to the time that depot staff spend on Non-Blue Box materials, or the percentage of space at the depot allotted to Non-Blue Box materials.

If you are still having trouble allocating IC&I and Non-Blue Box percentages, contact the Authority at datacall@rpra.ca for assistance.

-

The regulation requires that each eligible source is allocated to a single producer, or group of producers represented by the same PRO. The rules will determine the methodology for assigning eligible sources to producers/PROs. PROs share liability with producers for performance.