Frequently Asked Questions

Top FAQs (8)

Click the question to read the answer.

-

You are considered a battery producer under the Batteries Regulation if you market batteries into Ontario and meet the following requirements:

- Are the brand holder of the battery and have residency in Canada;

- If there is no resident brand holder, have residency in Ontario and import batteries from outside of Ontario;

- If there is no resident importer, have residency in Ontario and markets directly to consumers in Ontario (e.g., online sales); or

- If there is no resident marketer, does not have residency in Ontario and markets directly to consumers in Ontario (e.g., online sales).

Even if you do not meet the above definition, there may be circumstances where you qualify as a producer. Read the Batteries Regulation for more detail or contact the Compliance and Registry Team for guidance at registry@rpra.ca or (647) 496-0530 or toll-free at (833) 600-0530.

-

You are a Blue Box processor if you process Blue Box material that was supplied to a consumer in Ontario for the purposes of resource recovery.

For the purpose of resource recovery, processing includes, and is not limited to:

- Sorting

- Baling

- Paper and cardboard shredding

- Plastic reprocessing include grinding, washing, pelletizing, compounding, etc.

- Crushed glass reprocessing

- Aluminum and steel reprocessing

See our FAQs to understand “Who is a consumer under the Blue Box Regulation”.

-

See our FAQ to understand “What is blue box product packaging?”.

Product packaging added to a product can be added at any stage of the production, distribution and supply of the product. A person adds packaging to a product if they:

- make the packaging available for another person to add the packaging to the product

- cause another person to add the packaging to a product

- combine the product and the packaging

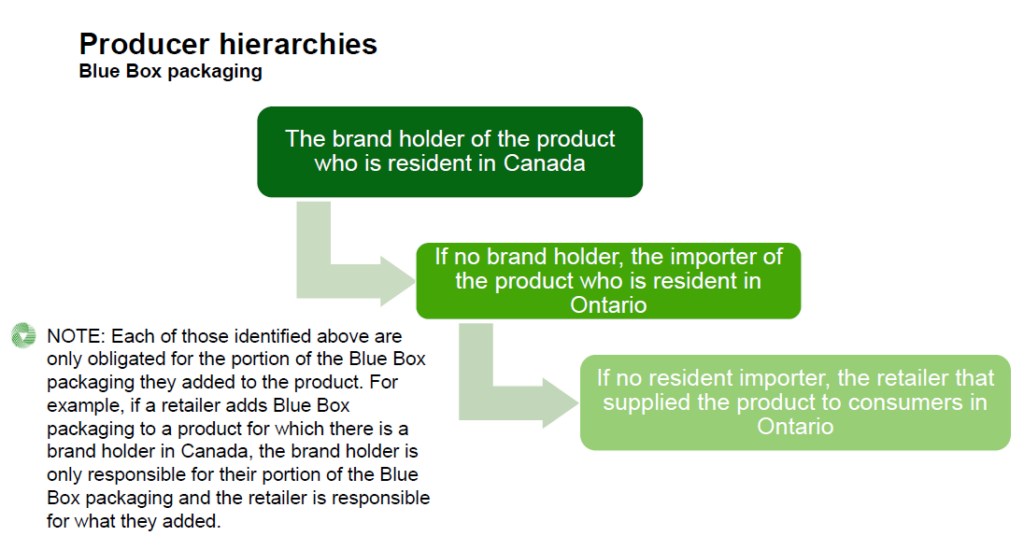

For the portion of the product packaging that a brand holder added to the product, a person is considered a producer:

- if they are the brand holder of the product and are resident in Canada

- if no resident brand holder, they are resident in Ontario and import the product

- if no resident importer, they are the retailer that supplied the product directly to consumers in Ontario

- if the retailer who would be the producer is a marketplace seller, the marketplace facilitator is the obligated producer

- if the producer is a business that is a franchise, the franchisor is the obligated producer, if that franchisor has franchisees that are resident in Ontario

For the portion of the product packaging that an importer of the product into Ontario added to the product, a person is considered a producer:

- if they are resident in Ontario and import the product

- if no resident importer, they are the retailer that supplied the product directly to consumers in Ontario

- if the retailer who would be the producer is a marketplace seller, the marketplace facilitator is the obligated producer

- if the producer is a business that is a franchise, the franchisor is the obligated producer, if that franchisor has franchisees that are resident in Ontario

For any portion of the packaging that is not described above, the producer is the retailer who supplied the product to consumers in Ontario.

-

See our FAQs to understand “What are paper products?” and “What are packaging-like products?”.

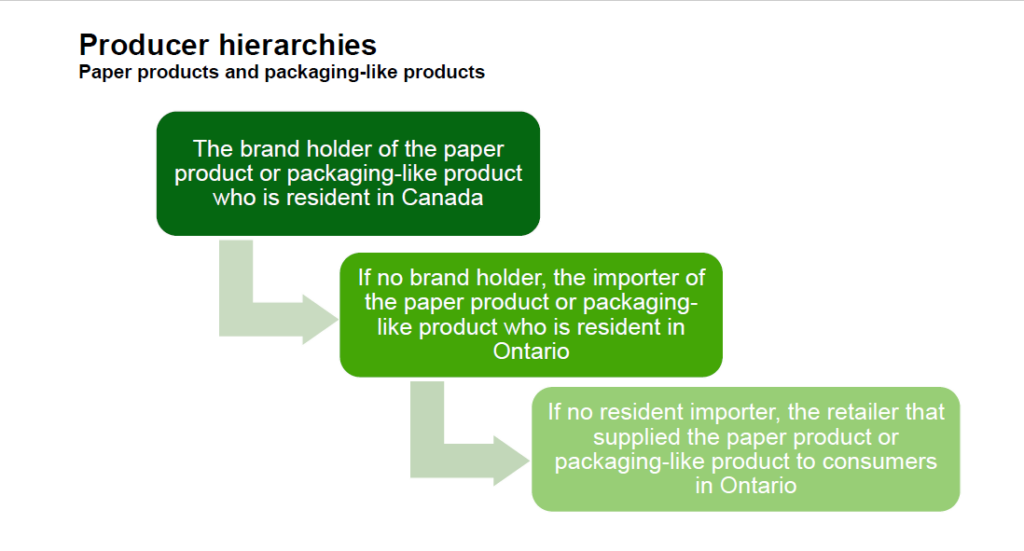

For paper products and packaging-like products, a person is considered a producer:

- if they are the brand holder of the paper product or packaging-like product and are resident in Canada

- if no resident brand holder, they are resident in Ontario and import the paper product or packaging-like product

- if no resident importer, they are the retailer that supplied the paper product or packaging-like product directly to consumers in Ontario

- if the retailer who would be the producer is a marketplace seller, the marketplace facilitator is the obligated producer

- if the producer is a business that is a franchise, the franchisor is the obligated producer, if that franchisor has franchisees that are resident in Ontario

-

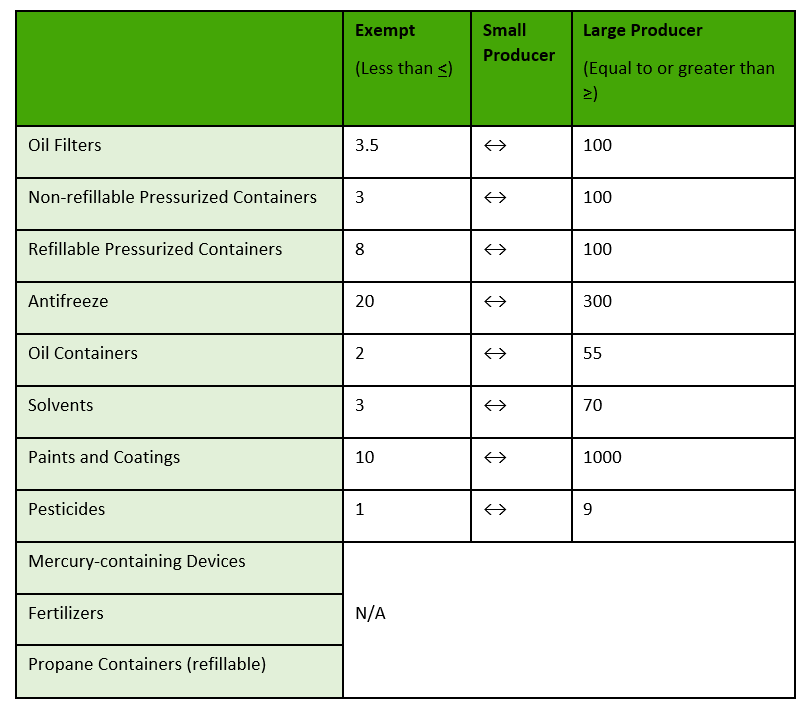

Producers can reference the following chart to determine if they are a small, large or exempt HSP producer. To calculate your average weight of supply to confirm that you are an exempt producer, reference the Registration Form.

Producer categories use the average weight of material (in tonnes) supplied in Ontario in the previous calendar year.

-

You are a tire collector if you operate a tire collection site where more than 1000 kgs of tires are collected in a year. A tire collection site is a location where used tires are collected, including:

- Repair shops, garages and vehicle dealerships (where used tires are collected as part of changing tires for customers)

- Auto salvage and recycling sites

- Any other site where end-of-life vehicles with tires are managed

You are not a tire collector if you operate a tire collection site where you:

- Also retread tires or process tires (you would be a tire retreader or a tire processor for those sites); or

- Only collect tires from the on-site servicing of vehicles that you own or operate (such as a site where you service your rental car fleet)

Municipalities can choose to operate collection sites, but they are exempt from registering with RPRA. For more information about municipal sites see: How does the Tires Regulation affect municipalities and First Nations?

-

You are a tire hauler if you transport tires in Ontario to a site for processing, reuse, retreading or disposal.

-

You are a tire processor if you receive and process tires for resource recovery or disposal. Processing means you are transforming tires into their constituent parts, including by shredding, chipping, grinding, cutting or cryogenic crushing. You are also a tire processor if you engage in activities to chemically alter tires, such as depolymerization.